-

INTEGRATED REPORT

INTEGRATED

REPORT

As permitted by the International

Framework, this Annual Report features a dedicated Integrated Report section, followed by Financial Statements and Supplementary Information. Structured per the Framework’s guiding principles and content elements, it provides a balanced view of our value creation process. As affirmed in the Annual Report of the Board of Directors on page 4, due diligence has been exercised to ensure its integrity, accuracy, and relevance to all stakeholders.

-

FINANCIAL STATEMENTS

FINANCIAL

STATEMENTS

The Financial Statements, including Accounting Policies and notes, fully comply with relevant Accounting Standards, providing a true and fair view of the Bank’s performance, financial position, equity changes, and cash flows. As confirmed in the Auditor’s Report, they are free from material misstatements. The Independent Auditor’s Report affirms an unmodified opinion on these Financial Statements.

-

SUPPLEMENTARY INFORMATION

SUPPLEMENTARY

INFORMATION

This section provides supplementary disclosures enhancing the Bank’s financial and non-financial reporting. It includes governance, compliance, sustainability disclosures, assurance reports, and key financial data, ensuring transparency and accountability. These annexures offer stakeholders insights aligned with best practices.

- Annex 1: Compliance with Governance Directions, Rules and Codes

- Annex 2: Basel III – Disclosures under Pillar III as per the Banking Act Direction No. 01 of 2016

- Annex 3: GRI Content Index

- Annex 4: Our Sustainability Footprint

- Annex 5: Disclosures Relating to Sustainability Accounting Standard for Commercial Banks

- Annex 6: Independent Assurance Reports

- Annex 7: The Bank’s Organisation Structure

- Annex 8: Financial Statements (US Dollars)

- Annex 9: Correspondent Banks and Agent Network

- Annex 10: Glossary of Financial and Banking Terms

- Annex 11: Acronyms and Abbreviations

- Annex 12: Alphabetical Index

- Annex 13: Index of Figures, Tables and Graphs

- Notice of Meeting – 56th Annual General Meeting

- Circular to the Shareholders on the First and Final Dividend for 2024

- Notice of Meeting – Extraordinary General Meeting

- Circular to Shareholders Pertaining to the Proposed Issue of Debentures

- Stakeholder Feedback Form

- Corporate Information

Integrated Report

Management discussion and analysis

Sustainable banking

Managing Director/Chief Executive Officer's and Chief Financial Officer's Statement of Responsibility

Independent Assurance Report - Internal Control

Creating enduring value for all stakeholders Figure - 17

Embracing sustainable banking

At Commercial Bank of Ceylon PLC, Sustainable Banking is more than just a strategy – it is a core philosophy that defines our approach to creating value for stakeholders while addressing pressing global and local challenges. As a leading financial institution in Sri Lanka, we recognise our unique responsibility to balance profitability with environmental, social, and economic sustainability. Guided by the principles of long-term value creation, our commitment to sustainable banking reflects our role as a catalyst for progress, a steward of the environment, and a partner in inclusive growth.

Leadership in sustainability and ESG integration

The banking sector plays a pivotal role in shaping the future by influencing financial markets and enabling broader societal goals. With the global shift towards integrating ESG and broader sustainability principles, the Bank has consistently demonstrated leadership in this transformative journey. We are proud to be the first Sri Lankan financial institution to achieve carbon-neutral status, a testament to our dedication to reducing our environmental footprint and embedding sustainability into our core operations. This landmark achievement is rooted in years of deliberate action, including robust greenhouse gas assessments, investments in renewable energy, operational efficiencies, and carbon offset programs such as reforestation initiatives.

As the 1st Bank to introduce Environmental and Social Management System (ESMS) in 2010 and the 1st to venture into Green Financing, we’re leading the charge towards sustainable growth and innovation.

Commercial Bank’s sustainability journey Figure – 18

Supporting global and national sustainability goals

In 2024, we expanded our focus on sustainability, leveraging our leadership position to further align with global frameworks such as SDGs. At the national level, we supported Sri Lanka’s Nationally Determined Contributions (NDCs) by promoting green financing and sustainable investments in renewable energy, climate-resilient agriculture, and low-carbon infrastructure. Through our alignment with the Sustainable Finance Roadmap of the CBSL, we have also championed industry-wide best practices, setting new benchmarks for ESG-driven solutions.

Integrating green banking with digital transformation

A cornerstone of our approach to sustainable banking is the seamless integration of digital transformation with green banking practices. By promoting paperless banking, energy-efficient facilities, and tech-driven financial inclusion, we have successfully reduced our operational environmental impact while enhancing customer convenience. Initiatives such as e-statements, digital payment platforms, and mobile banking channels have streamlined access to financial services for underserved communities, reinforcing our belief that digital innovation can drive both sustainability and inclusivity.

Elements of sustainable banking

- Responsible financing: Integrating ESG considerations into lending decisions to ensure investments contribute positively to the society and the environment.

- Financial inclusion: Extending banking services to rural and marginalised communities, empowering them to thrive.

- Sustainable products & services: Offering innovative solutions that align with stakeholder needs while fostering economic growth without compromising resources.

These elements guide our efforts to create a balanced approach that supports environmentally and socially responsible projects, broadens financial inclusion, and innovates for a sustainable future.

Elements of Sustainable Banking Figure – 19

Sustainable Banking

Responsible Financing

Stakeholders

engaged

Investors

Customers

Society and Environment

Capitals

addressed

Financial capital

Intellectual capital

Natural capital

Sustainable Banking

Financial inclusion

Stakeholders

engaged

Investors

Government institutions and regulators

Customers

Capitals

addressed

Financial capital

Manufactured capital

Sustainable Banking

Sustainable products and services

Stakeholders

engaged

Investors

Customers

Capitals

addressed

Financial capital

Manufactured capital

Intellectual capital

Building a resilient and inclusive future

As we move forward, the Bank remains steadfast in its commitment to lead the Sri Lankan banking sector towards a more sustainable and inclusive future. By embedding sustainability into every facet of our operations and fostering partnerships that drive collective progress, we create long-term value for all stakeholders. Our commitment to resilience, innovation, and shared prosperity underscores our aspiration of a banking sector that champions sustainability at its core.

Responsible financing

Balancing growth with integrity and sustainability

At Commercial Bank, responsible financing lies at the core of our sustainability agenda and strategic focus. We recognise that every lending and investment decision we make has significant implications for the society and the environment. Guided by a firm commitment to ethical principles, we ensure that our financial activities not only drive economic growth but also promote positive socio-economic outcomes while minimising environmental impacts.

In 2024, the Bank’s responsible financing efforts were deeply aligned with global and local sustainability frameworks, including the SDGs, the Sustainable Finance Roadmap of the CBSL, and the Sustainable Banking Principles of the Sri Lanka Banks’ Association (SLBA). Beyond regulatory adherence, responsible financing at the Bank represents a deliberate approach to aligning financial growth with the broader goals of sustainable development. Our initiatives throughout the year were built on robust risk management practices, rigorous regulatory compliance, and a steadfast dedication to creating long-term value for all stakeholders.

Strategic capital management and resilience

A foundation for sustainable growth

As a cornerstone of its commitment to responsible financing, the Bank continued to place strategic capital management at the forefront of its sustainability agenda in 2024. With the objective of ensuring resilience, supporting business expansion, and safeguarding stakeholder interests, the Bank undertook robust initiatives to strengthen its financial foundation. These efforts were underpinned by proactive governance frameworks and advanced capital monitoring systems.

Staying well-capitalised

The Bank demonstrated unwavering dedication to maintaining strong capital buffers to support its strategic growth objectives and ensure compliance with regulatory requirements. By adhering to the Capital Augmentation Plan submitted to the CBSL in 2023, the Bank successfully executed two transformative capital-raising initiatives in 2024:

- Basel III compliant debenture issue

The Bank raised Rs. 20 Bn. through the issuance of Basel III-compliant Tier II capital debentures. This initiative showcased the strong investor confidence in the Bank and boosted its Tier II capital, enhancing long-term financial stability. - Rights issue to bolster equity capital

A rights issue raised an impressive Rs. 22.5 Bn., significantly enhancing the Bank’s Tier I capital. This achievement marked the largest equity capital raising initiative by any private-sector bank in Sri Lanka, positioning the Bank as an industry leader in financial resilience.

Together, these initiatives elevated both Tier I and Tier II capital levels well above statutory minimum requirements, creating a solid platform for future growth. Combined with enhanced profitability in 2024 and forward projections, these measures provide significant leeway for the Bank to accommodate its planned expansion for the years ahead.

Regulatory capital ratios Table – 08

| As at December 31, | 2024 | 2023 |

| Tier 1 (Minimum Requirement 10.000%)* | 11.442 | |

| Total (Minimum Requirement 14.000%)* | 15.151 |

*For more details, please refer the Annex 2

Building a capital-efficient balance sheet for the future

Strengthening the balance sheet for efficient capital utilisation remains a cornerstone of the Bank’s strategic agenda, reflecting its commitment to fostering growth, resilience, and profitability. While the infusion of debt and equity capital has bolstered the Bank’s financial foundation, enabling it to mitigate risks and sustain operations in volatile market conditions, the Bank continued its efforts to optimise its capital structure. By striking a careful balance between operational stability and stakeholder confidence, these efforts are firmly aligned with global best practices.

As part of its continuous efforts to rebalance the balance sheet towards a more capital-friendly structure, the Bank has prioritised initiatives that align capital allocation with long-term strategic objectives. Rigorous monitoring systems have been implemented to track divisional capital consumption and evaluate the capital requirements of business segments, ensuring the prioritisation of high-impact projects. To further enhance efficiency and ensure that returns are commensurate with risks, the Bank introduced the RAROC (Risk-Adjusted Return on Capital) framework, enabling the monitoring of risk-based returns across various portfolios. This approach ensures that capital is deployed effectively, focusing on both profitability and sustainability.

In tandem with fostering a culture of capital-based decision-making, the Bank has aligned systems and processes to elevate governance standards and deliver cost-effective growth on a priority basis. These strategic actions bolster operational efficiency and reinforce the Bank’s competitive edge in an evolving financial landscape, ensuring value creation for stakeholders and long-term financial stability.

Proactive management of stress on capital

The Bank’s governance framework for capital management was instrumental in identifying and mitigating potential capital stress. By conducting periodic stress tests and scenario analyses, the Bank ensured preparedness for adverse market conditions and external shocks. Recognising the extremely volatile conditions faced by the industry in preceding years, the Bank further widened its stress scenarios and heightened the levels of stress for testing. These refined practices reflect the Bank’s proactive approach to maintaining resilience and adaptability in a rapidly evolving financial landscape.

Resilience as a strategic asset

As the Bank continues to navigate dynamic market conditions, its focus on strategic capital management remains unwavering. By leveraging its enhanced capital position, the Bank is well-poised to drive innovation, expand its lending portfolio, and support underserved sectors of the economy. Furthermore, the Bank’s commitment to responsible financing underscores its role as a catalyst for sustainable development, ensuring that its growth trajectory benefits all stakeholders while aligning with global regulatory frameworks and sustainability goals.

The above achievements reflect the Bank’s financial acumen and also demonstrate its resilience and adaptability qualities that will continue to define its success and sustainability in the years to come.

Optimising financial resources

Strategic management of financial resources

In 2024, the Bank continued to demonstrate financial prudence by optimising its asset and liability management strategies to ensure financial resilience and operational sustainability. The Bank adopted a forward-looking approach to funding and liquidity management, aligning its operations with evolving market conditions and global regulatory standards.

The Bank employs a comprehensive Asset and Liability Management (ALM) framework to optimise the utilisation of financial resources. By maintaining a balanced portfolio of assets and liabilities, the Bank ensures the alignment of maturity profiles, reduces mismatches, and minimises risks associated with interest rate volatility and currency fluctuations. To strengthen this approach, the Bank adopted proactive measures such as the following to enhance financial stability and resilience.

Dynamic portfolio adjustments: The Bank closely monitored market conditions to rebalance its asset portfolio, diversifying the loan book and the investments portfolio to mitigate risks and maximise returns.

Profitability and risk alignment: Lending strategies were carefully aligned with risk tolerance thresholds, ensuring a balance between growth objectives and sustainable profitability.

Strengthening funding and liquidity management with ALCO oversight

The Asset and Liability Committee (ALCO) played a pivotal role in driving the Bank’s funding and liquidity management strategies, ensuring resilience amid market volatility. Acting as the central decision-making body for balance sheet optimisation, ALCO guided the Bank’s approach to maintaining optimal liquidity levels, safeguarding financial stability, and mitigating risks associated with market fluctuations.

ALCO’s continuous monitoring of market liquidity allowed the Bank to anticipate funding needs effectively, ensuring that adequate cash reserves were maintained at all times to meet both short-term and long-term obligations without operational disruptions. Additionally, the Committee implemented robust forecasting models to navigate evolving market dynamics, enhancing the Bank’s ability to adapt to external shocks and seize emerging opportunities.

A key priority for ALCO was to maintain a well-diversified funding portfolio, ensuring stability and resilience across various dimensions, including tenor, currency, geography, and ticket size. While the Bank did not require funding from foreign sources in 2024 due to its strong liquidity position, its access to global funding markets remains a significant strategic advantage. This diversification, combined with the ability to tap into international funding avenues when required, enhances the Bank’s financial flexibility, mitigates concentration risks, and positions it to respond effectively to potential future funding needs. These measures collectively reinforce the Bank’s ability to support sustainable growth while maintaining a robust financial structure.

Moreover, ALCO introduced advanced analytics and scenario-based assessments to refine decision-making processes, enabling the Bank to align liquidity management strategies with regulatory requirements and industry best practices. These efforts underscore the Bank’s commitment to proactive financial stewardship, fostering confidence among stakeholders and positioning the institution for sustained success in a dynamic economic landscape.

Managing liquidity risks amidst evolving market conditions

As markets continued to navigate uncertainties, the Bank prioritised robust liquidity risk management practices to safeguard its financial health. These measures included stress testing, scenario analysis, and liquidity buffer maintenance, all of which ensured resilience in challenging conditions. To further strengthen its liquidity management framework, the Bank implemented proactive strategies such as the following:

- Stress testing for contingency planning: The Bank conducted regular stress tests to evaluate its liquidity position under adverse scenarios, ensuring preparedness for potential disruptions.

- Near real-time monitoring: Implementation of the new Treasury System with advanced tools and methodologies facilitated near real-time monitoring of liquidity positions, enabling swift decision-making to address emerging challenges.

Alignment with Basel III norms

The Bank’s liquidity and funding management practices were fully aligned with Basel III norms given below, reflecting its commitment to global best practices in financial risk management.

- Liquidity Coverage Ratio (LCR):

By maintaining a high-quality liquidity buffer, the Bank consistently achieved LCR compliance, demonstrating its ability to withstand short-term liquidity shocks. LCR for all currencies and Rupee as at December 31, 2024 were 454.36% and 529.20% (516.27% and 491.61% respectively, as at December 31, 2023) compared to the minimum requirement of 100%. - Net Stable Funding Ratio (NSFR):

The Bank focused on securing stable funding sources to support its medium- to long-term asset base, ensuring compliance with NSFR requirements. NSFR as at December 31, 2024 was 187.29% (193.70% as at December 31, 2023) compared to the minimum requirement of 100%.

For more details, please refer the Annex 2

Forward momentum in resource optimisation

As the Bank continues to strengthen its financial foundation, optimising financial resources remains a key strategic priority. Central to this effort is the Bank’s robust ALM framework, which is overseen by the ALCO and aligned with international best practices. This framework is further reinforced by the Treasury Middle Office, which continuously monitors market risks, ensuring that the Bank remains agile in responding to dynamic financial conditions.

By maintaining a careful balance between risk, liquidity, and profitability, the Bank’s ALM approach allows it to adapt to evolving market environments while safeguarding its financial stability. This proactive management ensures that the Bank not only meets its immediate financial obligations but also remains well-positioned to capitalise on emerging opportunities. Through effective resource allocation and disciplined oversight, the Bank is able to drive sustainable growth, meet regulatory requirements, and align its operations with long-term strategic objectives, reinforcing its resilience and stakeholder confidence in an increasingly volatile global economy.

To further enhance decision-making and automation within ALM and liquidity management, the Bank has procured several software modules focused on Asset and Liability Management and Liquidity Computation. These tools will empower ALCO to optimise the Balance Sheet more effectively, facilitating automation in liquidity-related computations, increasing computation frequencies, and enhancing near real-time monitoring capabilities. The implementation of these software solutions is currently underway, with live deployment scheduled in the near future.

Enhancing portfolio quality and risk management

Strengthening asset quality for sustainable growth

In 2024, the Bank achieved significant strides in enhancing the quality of its credit portfolio, driven by strategic initiatives and improved macroeconomic conditions. By leveraging advanced risk management tools, conducting rigorous evaluations, and ensuring prudent provisioning, the Bank demonstrated its commitment to sustainable financial performance and stability.

Improving credit portfolio quality through targeted strategies

The Bank has consistently focused on improving the quality of its credit portfolio by employing targeted strategies that address both pre- and post-sanction evaluations, ensuring a proactive approach to risk mitigation and enhanced asset quality, through measures such as;

Comprehensive credit

risk assessments:

Rigorous

credit appraisals serve as the

cornerstone of the Bank’s lending

decisions. These assessments

delve deeply into borrower

profiles, market conditions,

feasibility of the proposals, and

sector-specific risks, ensuring a

robust framework for prudent

credit allocation.

Sectoral diversification:

To minimise concentration

risks and enhance resilience

against economic uncertainties,

the Bank has strategically

diversified its lending portfolio

across industries, sectors and

geographies, demonstrating

strong fundamentals and growth

potential.

Active portfolio monitoring:

Regular reviews and monitoring

of the credit portfolio have

enabled the Bank to detect

emerging risks early. Leveraging

predictive capabilities of the

Early Warning Signals (EWS)

system, the Bank identifies

potential vulnerabilities within

the portfolio, enabling timely

corrective actions. This predictive

approach enhances the Bank’s

ability to safeguard asset

quality in a dynamic market

environment.

Independent credit risk reviews: The Bank’s IRMD conducts independent Credit Risk Reviews, providing an additional layer of oversight. These reviews assess the effectiveness of credit decisions, compliance with risk policies, and adherence to regulatory guidelines, ensuring a comprehensive evaluation of the credit landscape.

By integrating these strategies with advanced risk monitoring tools and independent reviews, the Bank has fortified its credit management processes. This proactive approach has enabled the Bank to preserve its asset quality and position the Bank to achieve sustainable growth in an increasingly complex financial landscape, as evidenced by the fact that the gross loans and advances portfolio recorded a 17.49% growth in 2024, compared to the industry average growth of 2.10%.

Prudent impairment provisioning to safeguard asset quality

As part of its prudent risk management strategy, the Bank took proactive measures to enhance impairment provisioning levels, ensuring financial stability and resilience. While asset quality improved notably in 2024, driven by a recovery in economic conditions and a positive shift in the Economic Factor Adjustment, the Bank revised its impairment policy to introduce more stringent measures.

One such revision involved making a 100% provision for facilities in the Non-Performing category for over three years, irrespective of collateral, reflecting the Bank’s commitment to maintaining a sound financial position. These measures resulted in a substantial increase in the Stage 3 provision coverage, which rose to 64.61% from 43.22% in the previous year, while the open credit exposure reduced to 15.06% from 38.69%.

This proactive approach underscores the Bank’s dedication to strengthening its resilience and ensuring that asset quality remains robust amidst evolving market dynamics.

Leveraging predictive analytics for smarter risk assessment

The Bank utilised predictive analytics and advanced data modeling techniques to strengthen its risk assessment and decision-making processes. By leveraging these innovative approaches, the Bank was able to proactively manage credit risk and enhance portfolio quality through the following key measures:

Early warning systems:

Predictive tools enabled

the Bank to identify potential

non-performing assets (NPAs) at

an early stage, facilitating timely

interventions and recovery

measures.

Data-driven insights:

Advanced

analytics provided deeper

insights into borrower and

repayment trends, enhancing the

accuracy of risk evaluation.

Customer risk scoring models:

Tailored models were developed

to align risk assessments with

the Bank’s strategic priorities and

regulatory requirements.

Conducting stress tests and scenario analyses to ensure financial stability

As part of its comprehensive risk management framework, the Bank conducted regular stress tests and scenario analyses to evaluate the resilience of its portfolio under adverse economic conditions. These measures played a crucial role in identifying vulnerabilities and enhancing the Bank’s preparedness for potential financial shocks through the following key approaches:

- Macro-stress testing:

Simulations based on varying macroeconomic scenarios allowed the Bank to assess the potential impact of external shocks on its financial position. - Capital adequacy under stress:

Stress testing results validated the Bank’s ability to maintain adequate capital buffers, ensuring compliance with regulatory standards and instilling stakeholder confidence. - Scenario planning for risk mitigation:

Scenario analyses informed the Bank’s contingency planning, enabling it to prepare for and respond effectively to evolving risks.

Outlook for portfolio quality and risk management

The Bank’s strategic focus on enhancing portfolio quality and risk management underpins its vision for sustainable growth. By integrating advanced technologies, adopting rigorous evaluations, and aligning with global best practices, it is well-positioned to navigate the challenges of a dynamic economic environment. These efforts not only reinforce the Bank’s financial stability but also enhance its ability to deliver value to all stakeholders.

Diversification of lending portfolio

Expanding credit horizons for inclusive and sustainable growth

The Bank’s lending portfolio diversification in 2024 reflected its commitment to inclusive and sustainable development. By prioritising key growth sectors, expanding green financing, and leveraging regional opportunities, the Bank ensured that its credit portfolio aligned with national and global priorities while mitigating risk through diversification strategies.

Lending to priority sectors

The Bank remained unwavering in its commitment to supporting socio-economic upliftment by channeling credit towards underserved and high-potential sectors, reinforcing its role as a key enabler of inclusive economic growth.

ComBank biggest lender to Sri Lanka’s SMEs for 4th consecutive year

The Bank became the biggest lender to Sri Lanka’s SME sector for the 4th consecutive year accounting for nearly a one third of the value of the loans disbursed by a total of 17 state and private sector lending institutions.

In 2023, the Bank lent Rs. 231.655 Bn. out of the total loans of Rs. 704.142 Bn. to SMEs, accounting for 33% of the total in value terms according to the Ministry of Finance Annual Report 2023.

Driving socio-economic upliftment through strategic credit allocation

Empowering SMEs

Largest SME lender for four years, providing tailored financial solutions for working capital, infrastructure expansion, and capacity-building initiatives.

Contribution to SDGs:

Promoting women entrepreneurs

Tailored financing solutions to empower women-led businesses, providing accessible credit and technical support.

Contribution to SDGs:

Supporting microfinance initiatives

Extended financial services to underserved rural populations, fostering self-reliance and community development.

Contribution to SDGs:

A core focus of this effort has been empowering SMEs, recognising their vital contribution to job creation, innovation, and national economic resilience. For the past four years, the Bank has maintained its position as Sri Lanka’s largest lender to SMEs, underscoring its sustained dedication to this crucial segment. Through tailored financial solutions, the Bank has enabled SMEs to access working capital, expand infrastructure, and undertake capacity-building initiatives across diverse industries. By prioritising SMEs, the Bank has nurtured entrepreneurship, stimulated innovation, and strengthened economic sustainability.

In addition, the Bank has taken significant steps to promote women entrepreneurs, introducing specialised financing solutions that provide accessible credit and technical support. These initiatives have encouraged female-led businesses, enhanced economic inclusion, and empowered women to contribute meaningfully to the nation’s growth.

Beyond SMEs and women-led businesses, the Bank has extended its outreach through microfinance initiatives, ensuring financial services reach underserved rural communities. By facilitating access to credit and fostering self-reliance, these programs have supported grassroots entrepreneurship, strengthened community development, and uplifted livelihoods in marginalised regions.

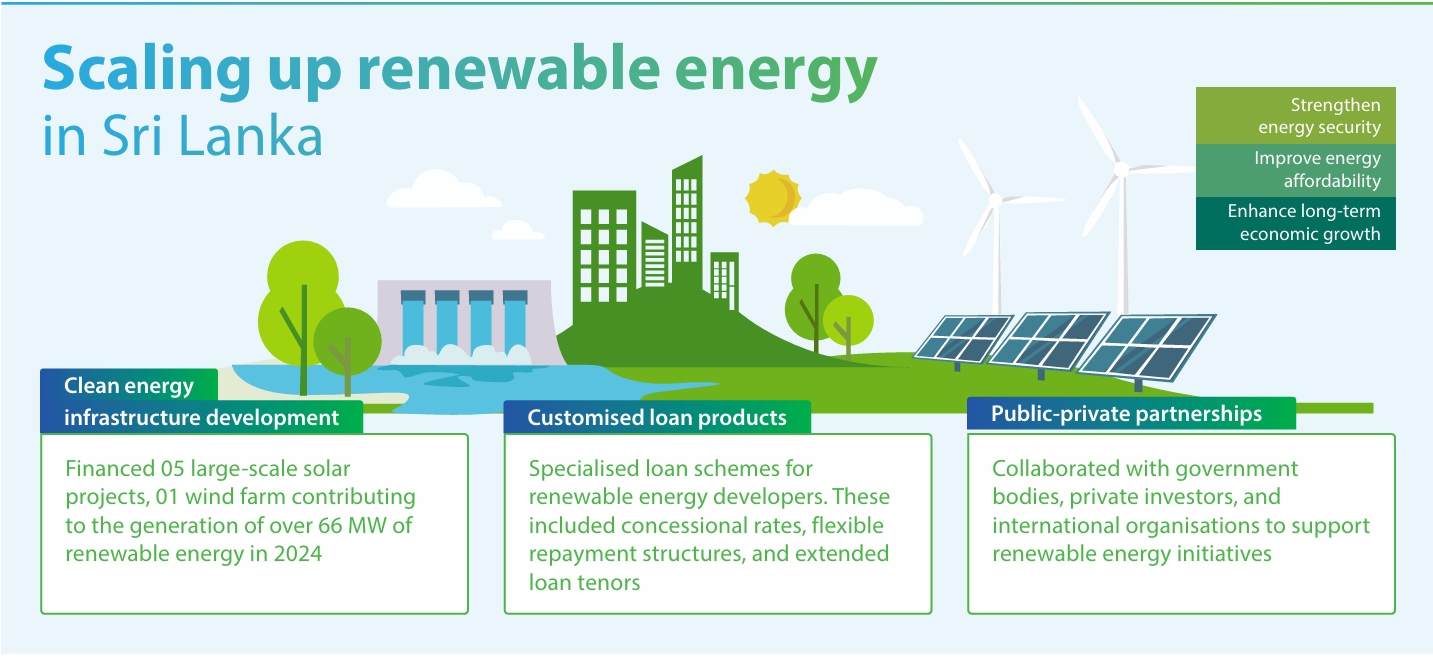

Expanding green financing

Aligned with its sustainability agenda, the Bank significantly expanded its green financing efforts to address environmental challenges and promote climate-resilient economic practices. By integrating sustainability into its lending strategy, the Bank facilitated projects that contribute to a low-carbon economy and long-term environmental stewardship.

A key focus of this initiative was financing renewable energy projects, supporting the transition towards clean energy solutions. The Bank provided funding for solar, wind, and hydroelectric projects, empowering businesses and communities to reduce carbon emissions and enhance energy efficiency.

Additionally, the Bank extended credit to sustainable agriculture, enabling farmers and agribusinesses to adopt eco-friendly farming techniques such as organic cultivation and water-efficient practices. By encouraging responsible agricultural methods, the Bank played a role in enhancing food security while minimising environmental impact.

Beyond energy and agriculture, the Bank also supported funding initiatives such as green buildings, and eco-tourism developments. These investments underscored the Bank’s commitment to sustainability across multiple sectors, ensuring economic growth aligns with environmental conservation and climate adaptation.

Driving sustainability through green financing

Renewable energy projects

Financed solar, wind, and hydroelectric projects, supporting clients’ transition to clean energy while reducing carbon emissions and promoting sustainability.

Contribution to SDGs:

Sustainable agriculture

Provided credit to farmers and agribusinesses for eco-friendly practices, supporting organic cultivation, water efficiency, and sustainable agricultural growth.

Contribution to SDGs:

Climate-resilient infrastructure

Supported climate-resilient infrastructure through green buildings, and eco-tourism projects.

Contribution to SDGs:

Strategic diversification for risk mitigation and growth

Sectoral focus

Diversified into emerging sectors including technology, healthcare, and export-oriented industries.

Contribution to SDGs:

Regional outreach

Expanded presence in urban and rural markets, ensuring equitable credit access, bridging financial inclusion gaps, and fostering regional economic development.

Sectoral and geographic diversification of credit exposures

To mitigate risks and optimise growth, the Bank pursued a strategic diversification approach across sectors and geographies, ensuring a well-balanced and resilient portfolio.

A key component of this strategy was a sectoral focus, where the Bank diversified into emerging industries such as technology, healthcare, and export-oriented businesses. This expansion enabled the Bank to tap into new growth opportunities while effectively spreading risk across multiple high-potential sectors.

Additionally, the Bank strengthened its regional outreach, expanding its footprint in both urban and rural markets. By doing so, it ensured equitable access to credit, bridged gaps in financial inclusion, and fostered regional economic development.

Cross-border lending and regional expansion

Leveraging its expertise in cross-border financing, the Bank strategically expanded its international footprint, capturing new opportunities and strengthening its regional presence. This initiative enabled the Bank to support businesses and economies beyond national borders while reinforcing its role as a key financial facilitator in the region.

A major focus of this expansion was the Bank’s operations in Bangladesh, the Maldives, and Myanmar, where it provided tailored credit solutions, including trade financing and project loans. These financial solutions played a pivotal role in driving economic development in neighbouring countries, fostering growth across multiple industries.

Additionally, the Bank strengthened cross-border trade support, facilitating seamless trade financing solutions for businesses operating across international markets. By streamlining transactions and offering structured financial assistance, the Bank enhanced client satisfaction while deepening regional economic ties.

Expanding regional presence through cross-border financing

Bangladesh, the Maldives, and Myanmar

Provided tailored credit solutions, including trade financing and project loans, fostering economic development.

Contribution to SDGs:

Cross-border trade support

Facilitated seamless trade financing for cross-border businesses, enhancing client satisfaction and strengthening regional economic ties through efficient financial solutions.

Contribution to SDGs:

Outlook for portfolio diversification

As part of its responsible financing strategy, the Bank’s portfolio diversification initiatives are designed to balance growth with sustainability. By supporting priority sectors, expanding green financing, and pursuing regional opportunities, the Bank ensures long-term value creation for stakeholders while addressing pressing economic and environmental challenges. Reflecting its ambition to diversify further, the Bank established an International Banking Division effective January 01, 2025. This strategic initiative aims to expand the Bank’s footprint from subcontinental to cross-border operations, positioning it as the Sri Lankan bank with the highest international presence. This division will enhance focus and drive business growth in areas such as the Colombo Port City, Dubai International Financial Centre, and cross-border lending opportunities in new territories. Looking ahead, the Bank remains committed to refining its credit strategies to align with evolving market needs and global sustainability goals.

Customer centricity

The Bank places customer centricity at the heart of its Responsible Financing agenda, creating experiences defined by simplicity, transparency, and convenience. The Bank’s commitment is evident in its unwavering focus on understanding and addressing diverse customer needs while fostering meaningful relationships. By maintaining open, transparent communication, the Bank ensures customers are informed about its products, services, and policies, building trust and enabling proactive management of expectations. This transparency is coupled with tailored solutions, including restructuring and rescheduling of loan facilities, specialised account offerings, and segmented services, empowering customers to achieve their financial aspirations.

Customer segmentation: personalised solutions for every need

Customer segmentation remains a cornerstone of the Bank’s strategy, enabling the design of tailored products and services for distinct customer groups. This approach ensures not only the alignment of financial solutions with customer goals but also exceeds expectations. The strategy has necessitated internal enhancements, such as agile processes, to adapt to the evolving needs of its clientele. By leveraging segmentation, the Bank fosters loyalty and engagement while reinforcing the strength of its brand.

Customer segmentation Table – 09

| Criteria | High net-worth | Corporate | SME (Small and Medium Enterprises) | Micro customers | Mass market |

| Income/Size of relationship/ Business turnover/Exposure |

Individuals with banking relationships above set thresholds | Exposure> Rs. 250 Mn. |

Exposure< Rs. 250 Mn. and annual turnover <Rs. 1 Bn. | Exposure< Rs. 1 Mn. |

Individuals not falling into other categories |

| Price sensitivity | High | High | Moderate | Low | Low |

| Products of interest | Investment | Transactional, trade finance, and project loans |

Development lending, Leasing and project financing, Transactional |

Transactional | Transactional |

| Number of transactions | Low | High | High/Moderate | Low | Low |

| Level of engagement | High | High | High | Low | Low |

| Objective | Wealth maximisation | Funding and growth |

Funding, growth and advice | Funding and advice |

Personal financial needs |

| Background | Elite business community/ professionals | Rated, large to medium corporates/MNCs |

Medium business | Self-employed | Salaried employees |

| Number of banking relationships | Many | Many | A few | A few | A few |

| Level of competition from banks |

High | High | Moderate | Low | Moderate |

Channel mix and target market on perceived customer preference Table – 10

| Customer segment | Branches | Internet & Mobile Banking |

ATMs/CDMs CRMs |

Call centre | Relationship managers |

Business promotion officers |

Premier banking units |

| High net-worth | |||||||

| Corporates | |||||||

| SMEs | |||||||

| Micro | |||||||

| Millennials | |||||||

| Mass market |

Crafting a customer-centric future

Guided by its vision, mission, and 12 Service Commandments, the Bank introduced a comprehensive Customer Experience (CX) Vision and Service Oath to align employee behaviour with its commitment to delivering exceptional service. Recognising the evolving expectations of customers, the Bank took a transformative step in late 2023 by establishing the Customer Experience Unit, reinforcing its dedication to engagement, seamless service delivery, and customer satisfaction.

Spearheaded by the Chief Manager - Customer Experience, this specialised unit serves as the driving force behind the Bank’s commitment to embedding customer-centricity across all touchpoints. Through structured initiatives and continuous innovation, the Bank is actively reshaping its service culture to enhance customer interactions, optimise service standards, and elevate overall satisfaction levels.

In pursuit of these objectives, the Bank has implemented a series of targeted actions to enrich the customer experience, strengthen relationships, and position itself as a leader in service excellence.

ComBank voted “People’s Private Bank of the Year” for second successive year

The Bank has been voted the “People’s Private Bank of the Year” at the SLIM Kantar People’s Awards 2024 for the second consecutive year.

Key actions in 2024

Strengthening governance:

- Established a Customer Experience Steering Committee, that conducts quarterly meetings to oversee strategies, address challenges, and drive customer-focused initiatives Bank-wide.

- Introduced Leaders’ Guidance to Serving, featuring insights from Corporate Management to align leadership with service excellence.

Inspiring Staff:

- Launched an internal campaign under the inspiring theme “Service Beyond 100%” to reinforce a culture of service excellence.

- Developed Dos and Don’t service videos to guide service behaviours and standardise best practices.

Innovative Tools:

- Introduced Service Quality Dashboards across various units, providing visibility, accountability, and actionable insights.

- Streamlined customer journeys at service touchpoints to enhance efficiency and consistency.

Feedback mechanisms:

- Launched customer surveys and implemented action points based on feedback to foster a customer-centric approach.

- Strengthened First-Time Resolution (FTR) focus at the Contact Centre, driving efficiency and boosting customer satisfaction

Service huddles:

- Introduced weekly Service Huddles with a structured framework to encourage team reflection, collaboration, and continuous improvement.

Measuring success:

Customer satisfaction metrics

The Bank’s unwavering commitment to excellence in customer service is validated by outstanding customer satisfaction metrics. In 2022, a comprehensive study conducted by Kantar Research showcased the Bank’s remarkable satisfaction scores. The findings showed the Bank’s superior customer satisfaction scores in all three key customer segments, Retail, Corporate and SME. These metrics highlight the Bank’s customer-centric philosophy, solidifying its position as an industry leader in delivering exceptional banking experiences tailored to diverse customer needs.

Through its strategic focus on passionate service, actionable insights, and the integration of cutting-edge technology, the Bank continues to raise the bar for customer satisfaction. By striving to achieve best-in-class Net Promoter Scores (NPS), it reaffirms its ambition to set new benchmarks in customer experience and establish itself as a service leader in the banking sector.

Customer Experience Performance Statistics Table – 11

| Key Performance Indicators | 2024 | 2023 | |

| Contact Centre | Inbound operation voice calls | ||

Service Level 80% within 20 sec Service Level 80% within 20 sec |

66% | 77% | |

Abandoned Rate Less than 5% Abandoned Rate Less than 5% |

7% | 6% | |

| First Call Resolution Rate (FCR) | 74% | N/A | |

| Customer experience | Total Net Promoter Score (NPS) | ||

Maintain above 35 Maintain above 35 |

30 | N/A |

Driving digital transformation for

customer experience

The Bank integrates technology to streamline processes, enhance efficiency, and simplify the customer journey. The upcoming Corporate Banking App exemplifies this effort, offering comprehensive capabilities across lending, deposits, trade, and treasury services. The App aims to address talent shortages through automation, improve operational efficiency, and deliver an intuitive, integrated digital experience for corporate clients. Additionally, the Bank’s broader technology-driven CX initiatives include customer journey automation, QR payment innovations, biometric authentication, and AI-driven chatbots to create seamless, contactless banking experiences.

Combank opens first Digizone experience

Opening the first “DigiZone”, located at the Bank’s Wellawatte branch, enabling visitors to experience any of the digital services offered.

Continuous innovation in customer experience

Customer experience is at the forefront of the Bank’s operations, focusing on creating seamless and standardised journeys, offering one-stop solutions, and enhancing processes to reduce turnaround times. Regular customer feedback, CRM-driven insights, and personalised promotions help refine services to align with evolving customer preferences. The Bank also prioritises training employees to enhance customer interactions and leverage technology to maintain a customer-first ethos.

By embedding customer centricity into its operations and leveraging cutting-edge digital solutions, the Bank reaffirms its commitment to delivering personalised, transparent, and future-ready financial services. This approach strengthens customer relationships and ensures that the Bank remains a trusted partner in achieving their financial goals in a fast-evolving digital era. Through a blend of technology, customer focus, and innovation, the Bank continues to redefine excellence in customer experience.

Adoption of the Battlecard concept: Strengthening competitive strategy in 2024

Since the beginning of 2024, the Bank adopted the innovative “Battlecard” concept to strategically position the Bank in an increasingly competitive market landscape. Designed to identify market dynamics, competitor offerings, and growth opportunities, the Battlecard acts as a blueprint to enhance the Bank’s market share in deposits and advances.

The Battlecard focused on addressing customer pain points highlighting gaps between competitors and the Bank. Key differentiation areas identified included transitioning to a sales-oriented mindset through centralised operations, automation, and enhanced process-driven approaches.

The competitive analysis mapped key players in the industry - each with unique strengths and weaknesses, which helped the Bank generate invaluable insights that suggested opportunities for differentiation. Leveraging these insights, the Bank has devised strategies to establish itself as the preferred choice for customers.

To drive market differentiation, the Bank introduced three strategic initiatives:

- Wallet share increase:

Aiming to grow deposits and advances through SME and corporate client-focused funnel management. - Centralised operations for back-office work:

Enhancing operational efficiency while fostering a proactive sales culture. - Customer-centric approach:

Introducing expedited credit approvals through automation and pre-approved limits for top-tier customers.

With meticulously outlined action plans and clear timelines for seamless execution in 2024, the Bank’s adoption of the Battlecard concept exemplifies its unwavering commitment to growth, operational excellence, and unparalleled customer satisfaction. By focusing on maintaining portfolio quality and bridging market gaps through innovative strategies, the Bank is strategically positioned to drive sustainable growth and adapt to the evolving dynamics of the banking industry. This forward-thinking approach reinforces the Bank’s ability to deliver value while navigating competitive challenges, ensuring resilience and success in an increasingly dynamic financial landscape.

Governance and compliance excellence

Embedding governance for responsible and ethical banking

The Bank maintained its leadership in governance and compliance by implementing robust frameworks designed to uphold ethical banking, ensure regulatory compliance, and foster a culture of accountability. The Bank’s approach to governance excellence reinforced its commitment to transparency, integrity, and the highest ethical standards in all its operations.

Strengthening ESG governance frameworks

To align with its Sustainability Framework, the Bank further enhanced its governance mechanisms to integrate ESG principles into its core business processes. These efforts ensure that sustainability remains a fundamental part of decision-making, risk management, and stakeholder engagement through the following key initiatives:

- ESG integration in decision-making:

All financing decisions are rigorously evaluated against ESG criteria, ensuring alignment with sustainable and responsible business practices. - Board-level oversight:

The Bank’s Board of Directors actively oversees ESG-related initiatives, embedding sustainability considerations into strategic planning and risk management. - Stakeholder accountability:

Regular engagement with stakeholders ensures that the Bank’s ESG commitments reflect their expectations while driving sustainable value creation.

Anti-money laundering (AML), Combating financing of terrorism (CFT) and anti-bribery and anti-corruption measures

The Bank remained steadfast in its commitment to preventing financial crimes by continually enhancing its AML and anti-bribery frameworks. Leveraging advanced monitoring technologies, the Bank strengthened its capacity for real-time detection and prevention of suspicious activities, aligning its operations with global AML standards. These robust systems not only enhanced compliance but also fortified stakeholder trust in the Bank’s ethical practices.

A zero-tolerance approach to bribery was at the forefront of the Bank’s strategy. Strict anti-bribery policies were rigorously enforced across all operations, complemented by comprehensive training programs. These programs empowered employees and third-party partners with the knowledge and tools to uphold the highest standards of integrity, ensuring ethical conduct at every level of the organisation.

Number of permanent employees who completed on-line AML e-learning course and obtained the certification – 3,909 (78% of the total permanent employees in Sri Lanka)

Additionally, the Bank maintained a meticulous approach to regulatory reporting. Comprehensive systems and procedures were in place to ensure compliance as well as timely and accurate submission of reports on suspicious transactions to relevant regulatory authorities. The Bank is cognisant of its role and requirements to be prepared, from the perspective of the National Risk Assessment (NRA) that is going to be conducted towards the latter part of 2026. This proactive stance underscored the Bank’s unwavering dedication to compliance, transparency, and the safeguarding of the financial ecosystem from illicit activities. Through these measures, the Bank mitigated risks while reinforcing its reputation as a responsible and vigilant financial institution.

Ethical banking practices and conduct risk management

Ethical banking remains a cornerstone of the Bank’s operational philosophy, supported by comprehensive frameworks to mitigate conduct risk. This commitment ensures that every action taken by the Bank aligns with its core values, fostering trust among stakeholders and reinforcing the Bank’s position as a responsible financial institution.

A robust Code of Ethics serves as the foundation for employee behaviour, ensuring that all decisions and actions are guided by the principles of transparency, responsibility, and ethical behaviour. This framework is further strengthened through regular training and awareness programs, which focus on ethical banking, customer fairness, and conflict of interest prevention. These initiatives empower employees to uphold the highest standards of professional conduct while fostering a culture of accountability and ethical behaviour.

The Conduct Risk Management Policy plays a pivotal role in maintaining an effective risk culture. This Group-wide policy ensures that the Bank engages in fair and ethical practices with customers, employees, and other stakeholders while establishing clear accountability for all actions. By adopting a preventive approach, this Policy enables the Bank to proactively address risks, ensuring that its operations remain ethically sound and aligned with stakeholder expectations.

The IRMD actively oversees and addresses risks that could impact operational integrity, ethical behaviour, or stakeholder trust. Leveraging the principles of the Conduct Risk Management Policy, this team ensures that ethical considerations are deeply integrated into the Bank’s risk management strategy. These efforts collectively reinforce the Bank’s unwavering commitment to ethical behaviour, responsible banking, and robust corporate governance.

Ensuring compliance with regulatory and ESG standards

The Bank consistently meets and exceeds local and international regulatory requirements, reinforcing its position as a model of compliance excellence. Through a structured approach to governance, financial transparency, and sustainability, the Bank ensures adherence to global best practices in the following key areas:

- Basel III and SLFRS compliance:

The Bank adhered to Basel III capital adequacy standards and Sri Lanka Financial Reporting Standards (SLFRS) ensuring robust financial health and transparency. - Alignment with ESG standards:

By aligning its practices with global frameworks such as the SDGs, the Bank demonstrated its commitment to addressing global challenges. - Periodic audits and assessments:

Independent audits and compliance assessments ensured adherence to regulatory and ESG standards, reinforcing accountability and operational excellence.

Outlook for governance and compliance

As financial ecosystems become increasingly complex, the Bank remains committed to strengthening its governance frameworks and compliance mechanisms. By embedding ESG principles, mitigating financial crime risks, and fostering ethical banking practices, the Bank continues to uphold its reputation as a trusted and responsible financial institution. Looking ahead, the Bank aims to leverage technological advancements and global best practices to further enhance governance excellence and support sustainable growth.

Climate risk management

Proactively addressing climate-related risks

In recognition of the growing impact of climate change on financial systems, the Bank has prioritised climate risk management as a critical aspect of its governance and operational strategy. By leveraging advanced tools, conducting rigorous stress testing, and addressing the challenges of green financing, the Bank continues to ensure resilience against climate-related uncertainties while supporting sustainable economic growth.

ComBank first Lankan Bank to join PCAF – the global Partnership for Carbon Accounting Financials

The Bank became the first Sri Lankan bank to be a signatory to the Partnership for Carbon Accounting Financials (PCAF), a global initiative that enables signatories to measure and disclose the greenhouse gas (GHG) emissions associated with their financial activity.

The Bank’s ground-breaking engagement with PCAF is supported by the International Finance Corporation (IFC) and is a pivotal element of the Bank’s Climate Transition Plan.

Identifying climate-related risks and opportunities

In line with SLFRS S2: Climate-Related Disclosures and global best practices, the Bank recognises the need to systematically identify and assess the financial implications of Climate-Related Risks and Opportunities (CRROs). Understanding these factors is critical for ensuring the Bank’s long-term resilience and enabling strategic decision-making in a rapidly evolving economic and regulatory landscape.

The Bank has conducted an analysis of both physical risks (e.g., risks arising from extreme weather events and changing climate patterns) and transition risks (e.g., risks associated with the shift to a low-carbon economy). Simultaneously, the Bank has identified climate-related opportunities that align with its strategy to support sustainable economic growth and promote a greener financial ecosystem.

This proactive approach enables the Bank to embed climate considerations into its risk management frameworks, lending practices, and investment strategies. It also provides the foundation for climate stress testing and scenario analysis, ensuring that the Bank remains well-prepared to navigate future climate-related uncertainties while capitalising on sustainable opportunities.

CRROs identified in relation to the Bank are given in Risk Governance and Management section on pages 254 to 284.

Mitigating green financing risks

While the Bank continues to expand its green financing portfolio, it acknowledges the inherent risks associated with this segment, including regulatory inconsistencies and market challenges. To address these

risks and ensure the sustainability and viability of its green financing initiatives, the Bank has implemented the following strategic measures:

- Addressing regulatory gaps:

The Bank actively engages with regulators and policymakers to align its green financing practices with national and international sustainability guidelines, ensuring clarity and consistency. - Due diligence in green projects:

Comprehensive due diligence processes assess the technical, environmental, and financial viability of green projects, reducing the risk of under performance or non-compliance. - Diversifying green financing portfolio:

The Bank’s green financing initiatives span multiple sectors, including renewable energy, energy efficiency, and climate-resilient agriculture, minimising concentration risk.

Way forward for climate risk management

As the global climate risk landscape continues to evolve, the Bank is resolute in its commitment to enhancing risk management capabilities and integrating climate considerations into all aspects of its operations. Recognising the critical need for proactive measures, the Bank has outlined a strategic pathway for addressing CRROs.

Key focus areas for the future include:

- Expanding predictive analytics:

Leveraging advanced predictive analytics tools to identify emerging climate risks and assess their potential impact on operations, portfolios, and stakeholder interests. - Enhancing stakeholder engagement:

Strengthening collaboration with regulators, industry peers, and other stakeholders to address gaps in climate related regulations and frameworks, ensuring alignment with international best practices and local requirements. - Investing in innovative tools

and technologies:

Continuing investments in advanced tools and technologies that enhance the Bank’s ability to monitor, assess, and mitigate climate risks effectively. - Advancing financed emissions

calculations:

The Bank signed a Memorandum of Understanding (MOU) with Partnership for Carbon Accounting Financials (PCAF) to become an official signatory, demonstrating its commitment to robust carbon accounting practices.

By embedding climate risk management into its governance frameworks and decision-making processes, the Bank reaffirms its position as a sustainable financial institution. The Bank’s forward-thinking approach prioritises resilience, accountability, and long-term value creation, ensuring its ability to navigate the complexities of a changing climate while fostering sustainable growth. In 2025, the Bank will actively work on formulating detailed scorecards to assess climate-related risks within the ICAAP framework, specifically focusing on its lending portfolio, and developing processes to extract and interpret climate risk data for financial disclosures in alignment with SLFRS S1 and S2. These targeted initiatives further reinforce the Bank’s commitment to integrating climate considerations into its operations, enabling informed decision-making and transparent reporting to stakeholders.

The Group Environmental and Social Risk Management Policy

The Bank has implemented a Group Environmental and Social Risk Management Policy that provides a comprehensive framework for managing environmental and social (E&S) risks across its operations. This policy covers E&S risk management within the Bank’s internal operations, ensuring responsible corporate practices, as well as E&S risk management in lending, integrating sustainability considerations into the Bank’s credit decision-making process. By aligning with international best practices, the policy reinforces our commitment to responsible banking and sustainable finance.

The full policy is available on the Bank’s website and can be accessed at https://www.combank.lk/info/file/272/group-environmental-and-social-risk-management-policy

Environmental and social management System

Integrating sustainability into lending practices

The Bank has established a comprehensive Environmental and Social Management System (ESMS) to ensure that all lending practices align with its commitment to sustainability. By embedding ESMS into its operations, the Bank safeguards social and environmental outcomes while promoting responsible business practices.

The ESMS has been developed based on the IFC Performance Standards, a globally recognised framework for managing E&S risks in private sector projects. These standards guide businesses and financial institutions in identifying, assessing, and mitigating E&S risks, fostering responsible and sustainable financing. The framework comprises eight key standards, addressing areas such as risk management, labour rights, resource efficiency, community health, safety, and security, land acquisition, biodiversity conservation, indigenous peoples' rights, and cultural heritage. Widely adopted by banks, investors, and development institutions, these standards ensure alignment with international sustainability frameworks, including the Equator Principles and the SDGs.

Embedding ESMS in lending practices

The Bank has embedded ESMS as a fundamental component of its risk evaluation and lending processes, ensuring that all financed projects adhere to stringent sustainability criteria. By integrating ESMS into its decision-making framework, the Bank enhances responsible lending while aligning with global sustainability goals through the following key measures:

ComBank wins double at ACCA Sustainability Reporting Awards

The 2023 Annual Report of the Bank was adjudged the overall runner-up and winner in the Banking category at the Sustainability Reporting Awards presented by the ACCA.

Embedding ESMS in lending practices Figure – 24

Monitoring and reporting social and environmental outcomes

The Bank’s ESMS framework prioritises continuous monitoring and transparent reporting to ensure accountability and measurable impact. Through a structured approach to data collection and stakeholder engagement, the Bank enhances its ability to assess and communicate the effectiveness of its sustainability initiatives through the following key measures:

- Outcome monitoring:

Regular audits and evaluations are conducted to track the social and environmental performance of funded projects, ensuring adherence to agreed upon sustainability goals. - Impact metrics:

The Bank employs key metrics, such as carbon emissions reduction, reduction in landfill, job creation, and community development, to measure the positive outcomes of its ESMS-aligned projects. - Transparent reporting:

Comprehensive reporting on ESMS performance is shared with stakeholders, reinforcing the Bank’s accountability and commitment to transparency.

Enhancing ESMS capabilities

The Bank is committed to continually refining its ESMS framework to address emerging sustainability challenges and opportunities, through many activities, inter alia the following:

- Capacity building:

Regular training programs equip employees with the skills to evaluate and monitor social and environmental risks effectively. - Technology integration:

Advanced digital tools, such as environmental risk assessment software and predictive analytics, are incorporated into ESMS processes for enhanced accuracy and efficiency. - Partnerships for sustainability:

Collaborations with international organisations and local regulators strengthen the Bank’s ESMS framework and expand its sustainability expertise.

Medium to long-term vision for ESMS

The Bank has seamlessly embedded ESMS into its lending practices to ensure its financial activities contribute to sustainable development while mitigating adverse social and environmental impacts. The Bank is committed to scaling the impact of ESMS by broadening its application across all lending portfolios, prioritising high-sustainability projects such as renewable energy and social infrastructure development.

The Group has implemented a robust strategy to avoid financing activities that pose E&S risks, ensuring responsible banking practices and compliance with regulatory frameworks. As part of this approach, the Group strictly adheres to a pre-identified list of banned or illegal practices, outlined in Annex I: “Banned/Illegal List” in the Group E&S Risk Management Policy, which prevents engagement in activities that could be harmful or non-compliant with regulations. Additionally, while certain project types or activities listed in the E&S Negative List (Annex I) may be legally permissible, they carry the potential for significant environmental degradation or social conflict. Given the Group’s low risk appetite for such activities, lending to these projects is restricted whenever possible. Furthermore, the Bank’s operations in Bangladesh adhere to additional sectoral exclusions, as stipulated in the “Exclusion List” of the “Guidelines on Environmental and Social Risk Management (ESRM) for Banks and Financial Institutions in Bangladesh (June 2022)”, reinforcing the Group’s commitment to sustainable and responsible financing.

By fostering a culture of sustainability among its clients, ESMS actively encourages the adoption of environmentally and socially responsible business models, reinforcing shared accountability. Moreover, the Bank aligns ESMS objectives with global frameworks, including the SDGs, as part of its medium to long-term strategy. Through this integration, the Bank demonstrates its leadership in sustainable banking, proving that financial growth and sustainability are mutually reinforcing goals. These efforts underscore the Bank’s commitment to a resilient, inclusive, and environmentally conscious future for all stakeholders.

Support for struggling businesses

The Bank recognises the critical role struggling businesses, particularly SMEs, play in the economy and has implemented a dedicated approach to support their revival and long-term sustainability. In 2024, the Bank focused on assisting businesses facing financial challenges through specialised interventions and responsive strategies.

Business Revival and Rehabilitation Unit

The Business Revival and Rehabilitation Unit (BRRU) exemplifies the Bank’s proactive approach to supporting distressed businesses in overcoming financial challenges and regaining stability. Formally established in July 2024, the BRRU has been instrumental in working closely with SMEs, identifying their unique pain points, and developing customised solutions to effectively alleviate financial distress.

Dedicated teams of financial advisors played a critical role, offering guidance on operational restructuring, cash flow optimisation, and market repositioning, ensuring businesses could achieve sustainable recovery. Recognising the need for additional financial support, the Bank also provided supplementary funding on a need basis, helping businesses navigate challenging circumstances more effectively.

Additionally, the BRRU focused on preventive measures, leveraging early warning systems to detect signs of financial strain and implementing timely interventions to safeguard businesses from potential insolvency. By the end of 2024, the unit had extended support to 65 borrowers, reinforcing the Bank’s commitment to being a trusted partner for businesses.

Restructuring and rescheduling loan facilities

The Bank acknowledged the pressing liquidity challenges faced by businesses and extended flexible loan restructuring and rescheduling options to support them in overcoming financial difficulties. Borrowers were given the opportunity to restructure their existing loans, allowing adjustments such as extended repayment periods and revised interest rates. These interventions effectively alleviated immediate financial pressures, giving businesses the breathing space needed for recovery.

To further support enterprises experiencing temporary cash flow constraints, the Bank rescheduled payment plans, enabling businesses to meet financial obligations without compromising operational continuity. Additionally, the Bank provided concessional terms to struggling SMEs, including reduced interest rates and tailored repayment structures, ensuring that they could focus on rebuilding and strengthening their businesses.

Despite the CBSL requiring the banks to classify such restructured facilities under Stage 2 or 3, which necessitates higher impairment provisions, the Bank strategically accommodated these businesses as a trade-off, prioritising long-term economic stability and business continuity over immediate financial impact.

Future outlook

Looking to the future, the Bank is poised to expand the scope of its BRRU by incorporating additional advisory resources and deploying advanced digital tools to enhance the efficiency and effectiveness of business recovery plans. The Bank also plans to deepen its collaboration with government agencies, industry associations, and NGOs to deliver a more holistic support ecosystem tailored to the unique challenges of struggling businesses. Additionally, efforts will focus on developing a comprehensive impact assessment framework to monitor recovery outcomes, measure the success of interventions, and refine strategies for maximum impact.

Cost optimisation and efficiency

Driving operational excellence through strategic cost management

The Bank continues to uphold its commitment to enhancing operational efficiency and cost-effectiveness. The establishment of robust frameworks and targeted initiatives such as business process re-engineering ensures that resources are optimised, and cost savings are reinvested into strategic growth and sustainability programs.

Cost Optimisation Committee: Enhancing decision-making and accountability

To streamline costs while maintaining high service quality, the Bank has empowered a dedicated Cost Optimisation Committee to oversee cost management and operational efficiency strategies. This Committee, comprising corporate and senior management representatives, evaluates expense patterns and identifies opportunities for cost savings across all divisions, ensuring focused governance and accountability. Through strategic measures, the Committee has implemented recommendations that have led to significant reductions in non-essential expenditures without compromising service delivery standards. Importantly, the cost savings achieved are systematically reinvested into innovation and sustainability projects, reinforcing the Bank’s commitment to long-term value creation for its stakeholders.

The efforts of the Committee led to significant cost savings during the year, primarily on account of energy, utility services, security, stationery, software licensing etc.

Improving operational efficiency in financing processes

The Bank has adopted modern tools and innovative approaches to improve the efficiency of its financing processes, ensuring greater speed and cost-effectiveness. These strategic enhancements streamline operations, reduce turnaround times (TAT), and optimise resource utilisation through the following key initiatives:

- Automation and digitisation:

Automation of workflows, including credit approvals, document management, and loan processing, has significantly reduced TAT and operational costs. - Streamlined decision-making:

By leveraging advanced data analytics and predictive modeling, the Bank ensures quick and accurate credit risk assessments, minimising redundant steps and inefficiencies. - Lean banking practices:

Initiatives such as paperless transactions and centralised operational hubs have contributed to a leaner and more agile banking model, reducing waste and redundancies.

Continuous monitoring and optimisation

Cost efficiency at the Bank is viewed as an ongoing journey, underpinned by regular reviews to ensure alignment with organisational objectives. Performance metrics related to cost efficiency are seamlessly integrated into key performance indicators (KPIs) for all departments, fostering a culture of accountability and continuous improvement. Employee engagement plays a pivotal role, with staff encouraged to contribute ideas for enhancing efficiency through reward-based programs, thereby driving participation and innovation. Additionally, the Bank employs benchmarking practices to compare its operational performance with industry standards, ensuring its efficiency measures align with global best practices and remain relevant in a dynamic financial environment.

Way forward for cost optimisation

To sustain its leadership in operational efficiency, the Bank aims to expand its cost optimisation initiatives, focusing on:

- AI-driven efficiency solutions:

Implementing AI and machine learning tools to predict cost-saving opportunities and continuing to further automate routine tasks. - Green banking initiatives:

Investing in energy-efficient technologies

Enhancing customer experience through more streamlined and cost-effective banking operations, ensuring both quality and affordability.

By maintaining a balance between cost efficiency and quality enhancement, the Bank ensures its financial sustainability and strengthens its capacity to invest in growth opportunities and community-focused initiatives.

ComBank adjudged Best Bank in Sri Lanka for 13th year by FinanceAsia

The Bank was adjudged as the Best Bank among Sri Lanka’s domestic banks for the 13th year by FinanceAsia, considered the world’s foremost information source on the Asian financial markets.

Financial inclusion

Bridging gaps and driving inclusive growth

At the Bank, financial inclusion stands as a cornerstone of our sustainable banking strategy, reflecting our unwavering commitment to making financial services accessible, affordable, and equitable for all. Recognising that access to financial services is a key enabler of socio-economic development, we place special emphasis on underserved communities, including women entrepreneurs, rural populations, and SMEs. By focusing on these segments, we strive to bridge the financial gap and foster inclusive economic growth across Sri Lanka and beyond.

In 2024, the Bank advanced its financial inclusion agenda through a series of targeted initiatives designed to empower marginalised groups and drive financial literacy. Our approach involved offering tailored financial products, enhancing service accessibility through digital and branch networks, and promoting financial education to enable better financial decision-making. These efforts were aligned with national priorities and global standards, underscoring our commitment to equitable and sustainable growth.

The Bank’s ongoing focus on financial inclusion not only supports national development objectives but also strengthens our role as a trusted financial partner in communities that have historically been excluded from mainstream financial systems. Through collaborative partnerships and innovative solutions, we continue to deliver meaningful impact, ensuring that no one is left behind on the path to economic progress.

Expanding access to banking

The Bank’s commitment to financial inclusion underscores its role in bridging the socio-economic divide and fostering equitable growth. In 2024, the Bank intensified its efforts to expand access to banking for underserved and rural communities through strategic initiatives, innovative technologies, and inclusive practices.

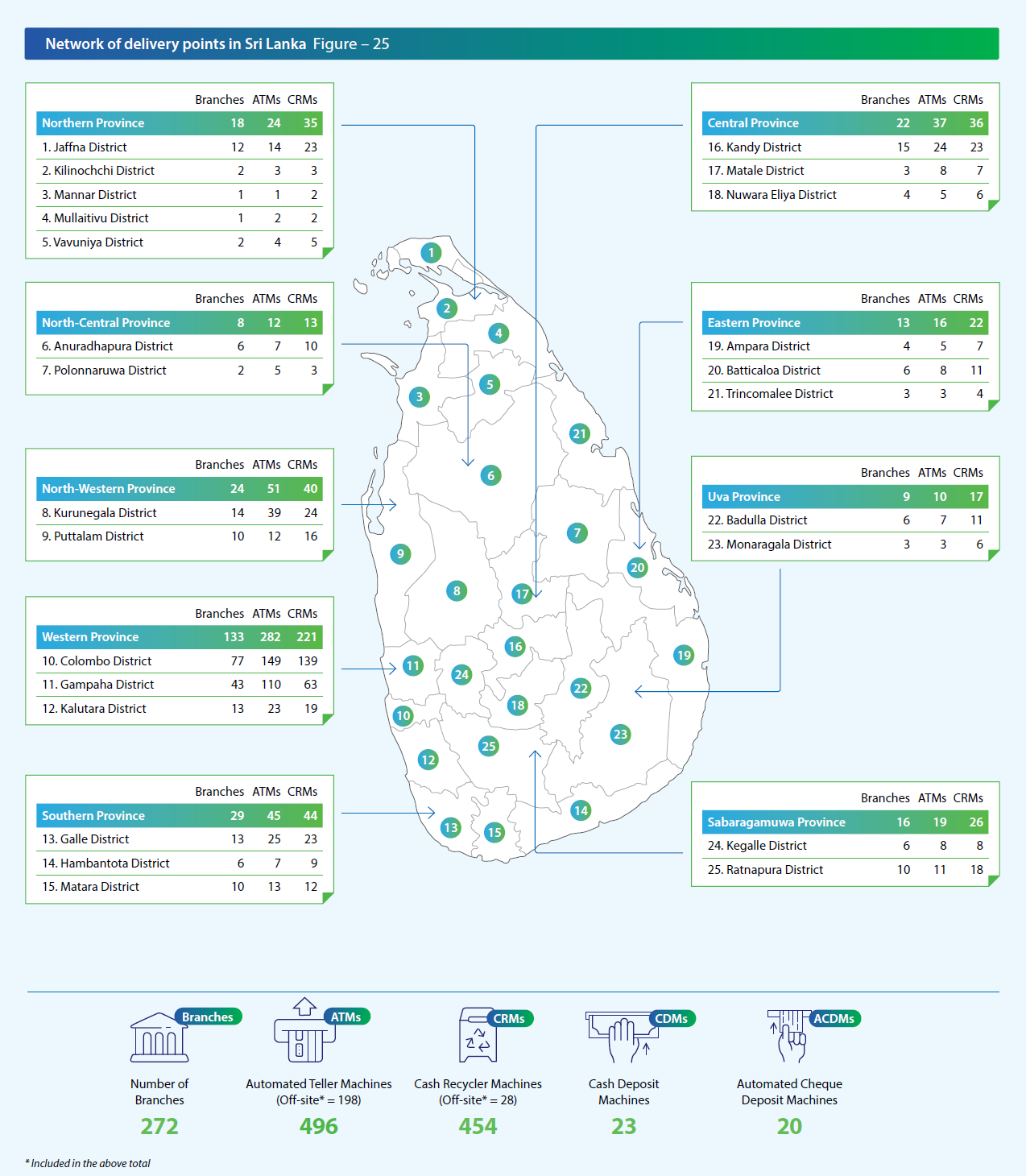

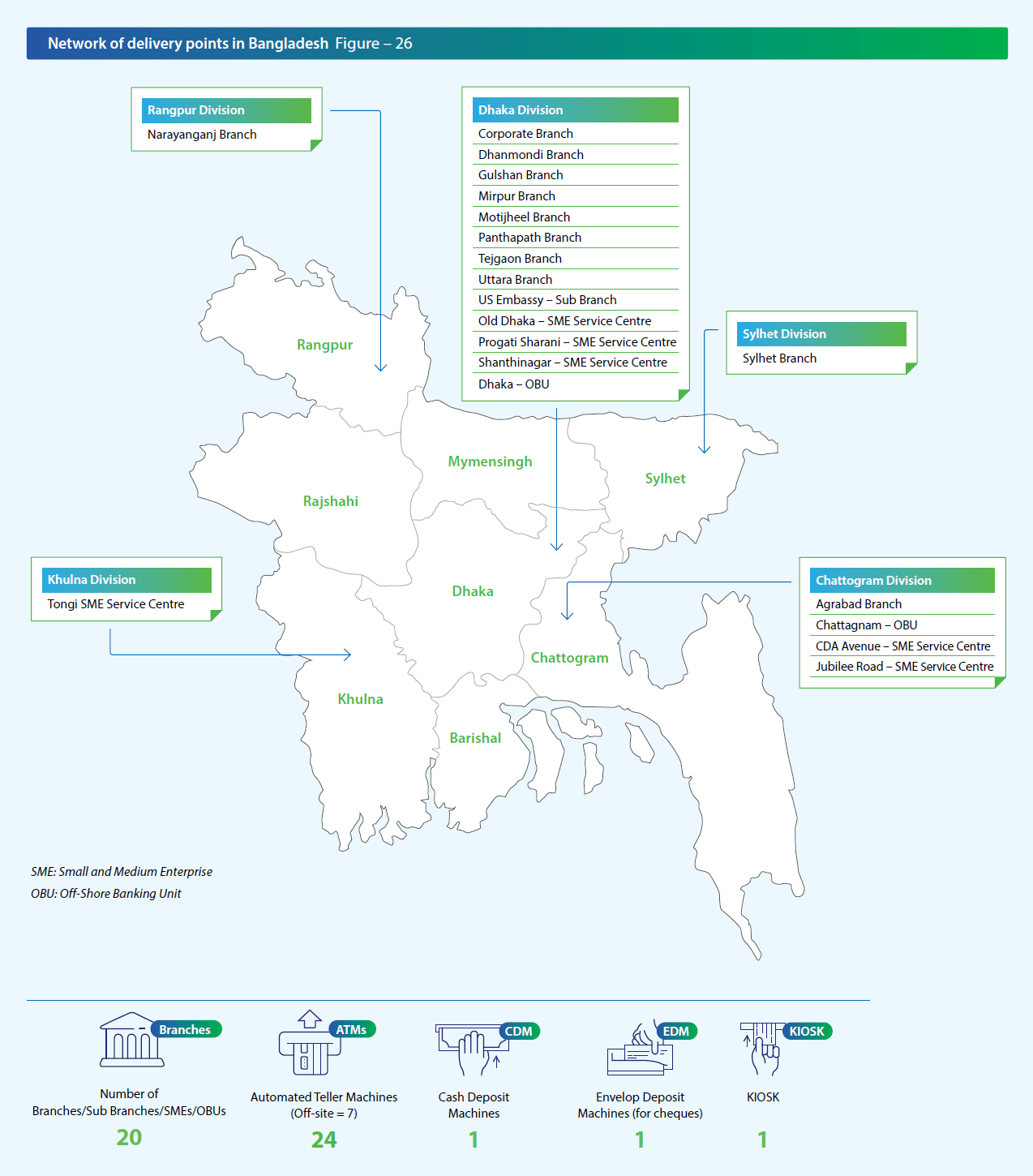

Our network of delivery points

Figures 25 and 26 given on pages 102 and 103 illustrate the Bank’s branch network, showcasing its reach across Sri Lanka and Bangladesh as a testament to its commitment to driving customer engagement and delivering value to stakeholders. In Sri Lanka, this expansive network provides unmatched accessibility, ensuring that customers from urban centers to remote regions can benefit from the Bank’s comprehensive suite of products and services. While the expansion of physical branches has slowed in recent years due to the increasing adoption of digital banking channels, the Bank strategically opened only one branch in 2024 in Puthukkudiyiruppu to enhance its presence while five branches were relocated for greater customer convenience. The wide branch presence complemented by an extensive map of ATMs and digital channels, facilitates financial inclusion, offering convenience to underserved communities and supporting local economies.

ComBank takes world-class banking to Puthukkudiyiruppu

Puthukkudiyiruppu in Sri Lanka’s Mullaitivu District became the latest town to receive World-class banking services from the Bank.

The Bank opened its latest branch in this fast-developing town sustained by the fisheries industry.

By leveraging this robust network, the Bank also enhances its ability to provide personalised customer service, strengthen relationships, and deliver tailored financial solutions. At a time when financial service channels are increasingly shifting to digital platforms, the branch network provides an essential balance by offering a personal touch that fosters trust, understanding, and human connection. This extensive reach positions the Bank as a key enabler of financial empowerment and growth for its customers across both countries.