-

INTEGRATED REPORT

INTEGRATED

REPORT

As permitted by the International

Framework, this Annual Report features a dedicated Integrated Report section, followed by Financial Statements and Supplementary Information. Structured per the Framework’s guiding principles and content elements, it provides a balanced view of our value creation process. As affirmed in the Annual Report of the Board of Directors on page 4, due diligence has been exercised to ensure its integrity, accuracy, and relevance to all stakeholders.

-

FINANCIAL STATEMENTS

FINANCIAL

STATEMENTS

The Financial Statements, including Accounting Policies and notes, fully comply with relevant Accounting Standards, providing a true and fair view of the Bank’s performance, financial position, equity changes, and cash flows. As confirmed in the Auditor’s Report, they are free from material misstatements. The Independent Auditor’s Report affirms an unmodified opinion on these Financial Statements.

-

SUPPLEMENTARY INFORMATION

SUPPLEMENTARY

INFORMATION

This section provides supplementary disclosures enhancing the Bank’s financial and non-financial reporting. It includes governance, compliance, sustainability disclosures, assurance reports, and key financial data, ensuring transparency and accountability. These annexures offer stakeholders insights aligned with best practices.

- Annex 1: Compliance with Governance Directions, Rules and Codes

- Annex 2: Basel III – Disclosures under Pillar III as per the Banking Act Direction No. 01 of 2016

- Annex 3: GRI Content Index

- Annex 4: Our Sustainability Footprint

- Annex 5: Disclosures Relating to Sustainability Accounting Standard for Commercial Banks

- Annex 6: Independent Assurance Reports

- Annex 7: The Bank’s Organisation Structure

- Annex 8: Financial Statements (US Dollars)

- Annex 9: Correspondent Banks and Agent Network

- Annex 10: Glossary of Financial and Banking Terms

- Annex 11: Acronyms and Abbreviations

- Annex 12: Alphabetical Index

- Annex 13: Index of Figures, Tables and Graphs

- Notice of Meeting – 56th Annual General Meeting

- Circular to the Shareholders on the First and Final Dividend for 2024

- Notice of Meeting – Extraordinary General Meeting

- Circular to Shareholders Pertaining to the Proposed Issue of Debentures

- Stakeholder Feedback Form

- Corporate Information

Integrated Report

Risk governance and management

Managing Director/Chief Executive Officer's and Chief Financial Officer's Statement of Responsibility

Independent Assurance Report - Internal Control

Navigating risks in a recovering economy

The year 2024 marked a pivotal turning point for Sri Lanka’s economy, as the country made significant strides in its post-crisis recovery. After the severe economic and foreign exchange crisis of 2022, the country's reforms, supported by the USD2.9 Bn. IMF program, started to show positive outcomes. Real GDP expanded by 5.2% in the first 9 months of 2024, the highest growth rate in 5 years, signaling renewed stability and confidence. Additionally, the successful completion of Sri Lanka’s debt restructuring in December 2024 further strengthened its fiscal position, laying a foundation for long-term economic resilience. Notably, these achievements were realised despite the political uncertainties of holding two key elections, underscoring growing institutional stability and policy continuity.

Amidst these developments, monetary policy played a crucial role in balancing growth with stability. To support economic expansion, the Central Bank of Sri Lanka (CBSL) gradually reduced the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) from 9% and 10% at the beginning of the year to 8.25% and 9.25% respectively by October 2024. In November, CBSL introduced a unified Overnight Policy Rate (OPR) at 8%, marking a key shift towards a simplified monetary policy framework. Combined with easing energy prices and administrative interventions, these measures anchored inflation at a medium-term target of 5%, with the Colombo Consumer Price Index (CCPI) recording a year-on-year deflation of 1.70% in December 2024.

Despite these positive developments, challenges persist. The IMF has emphasised the importance of fiscal prudence, particularly in achieving tax revenue targets and reforming state-owned enterprises, as the country works towards a primary surplus target of 2.3% of GDP in 2025. Structural vulnerabilities in Sri Lanka’s economy necessitate sustained policy discipline and continued reforms. Additionally, global economic uncertainties and potential commodity price fluctuations demand careful monitoring of the economic environment.

For the banking sector, these dynamics create a complex risk landscape. While economic recovery presents new opportunities, potential volatility in inflation, interest rates, and fiscal policy decisions necessitates proactive risk management. The Bank continued to strengthen its risk frameworks, with a heightened focus on stress-testing, scenario analysis, capital adequacy and internal measures ensuring regulatory compliance. Robust credit risk management remains critical as businesses and individuals adjust to evolving economic conditions. Furthermore, ongoing investments in digital transformation, operational resilience and skill development are vital to navigating an increasingly sophisticated risk landscape.

As the economy transitions from crisis to recovery, a prudent and forward-looking approach to risk management is more important than ever. The Bank remains committed to safeguarding its financial soundness while supporting the country’s economic revival. By staying agile and adaptive in a rapidly evolving landscape, the Bank will continue to manage risks effectively, ensuring sustainable growth and stability for all stakeholders.

Balancing growth and risk

As a leading financial institution, the Bank's operations center on financial intermediation and maturity transformation (refer to the Business Model for Sustainable Value Creation). As of December 31, 2024, the Bank managed an on-balance sheet asset base of Rs. 2,789.78 Bn., leveraging a capital base of Rs. 285.63 Bn., 9.8 times. While this leverage facilitates growth, it necessitates vigilant management of key risks – credit, operational, and market risks – aligned with Basel capital adequacy standards.

Beyond these core risks, emerging challenges such as digital disruptions, geopolitical volatility, and evolving regulatory frameworks introduce additional complexities. These external uncertainties, coupled with sector-specific risks, have the potential to influence all risk categories.

The Bank’s robust risk governance framework and proactive management strategies ensure a well-calibrated balance between risk and return. By continuously refining risk mitigation techniques, the Bank safeguards stakeholder confidence particularly among depositors and upholds its commitment to sustainable value creation.

Advancing risk management

As the authority for designing, calibrating, and deploying risk rating models, Integrated Risk Management Department (IRMD) has bolstered the Bank's compliance with regulatory requirements and enhanced the acceptability of these models. To ensure the robustness of credit risk evaluation frameworks for its lending operations, the IRMD has implemented external validation processes, covering all credit risk assessment models, subject to periodic review.

To extend its expertise beyond the core banking operations, IRMD has collaborated with Bank’s financial subsidiaries as well as Bangladesh operations to implement best practices in managing credit, operational, market, and environmental risks across the Group.

The introduction of Data Governance and Business Intelligence Unit marks another milestone, enabling enhanced regulatory compliance and robust internal data protection measures. With a view to enhance operational efficiency and to significantly reduce turnaround times in the SME lending, IRMD collaborated with the internal stakeholder units to recalibrate SME credit scoring models.

Looking ahead, IRMD’s strategic focus includes digital transformation initiatives such as implementing a Data Repository and Data Marts. Further, the Department has outlined a five-year plan to integrate Environmental, Social, and Climate Risk (ESCR) considerations into the Bank’s Risk Management Framework. This plan aims to align climate risk governance, scoring, and data-driven disclosures with the Bank’s sustainability goals, ensuring resilience, regulatory compliance, and sustainable growth.

By embedding sound risk management practices and leveraging technological advancements, IRMD continues to play a pivotal role in driving the Bank’s strategic objectives and ensuring long-term value creation.

Key objectives of risk oversight

The key objectives of the Bank’s risk governance framework and risk management function are designed to ensure resilience, stability, and sustainable growth. These objectives include:

- Building a robust risk management structure: Establishing a well-defined organisational framework for effective risk oversight and management across all levels of the Bank.

- Defining and aligning risk appetite: Articulating the desired risk profile, encompassing risk appetite and tolerance thresholds, to align with the Bank's strategic objectives.

- Fostering a positive risk culture: Promoting a culture where values, beliefs, and practices encourage proactive risk awareness and informed decision-making.

- Assigning responsibility and accountability: Clearly defining responsibilities for accepting, mitigating, transferring, or minimising risks, with a focus on recommending optimal approaches.

- Ongoing risk profiling: Continuously monitoring and evaluating the Bank’s risk profile against approved risk appetite to maintain alignment with strategic goals.

- Quantifying potential losses: Identifying plausible risk exposures and estimating potential financial and operational impacts.

- Conducting stress-testing: Regularly performing stress tests to ensure the Bank maintains sufficient capital and liquidity buffers to absorb shocks and meet obligations.

- Leveraging technology in risk management: Adopting advanced analytics and digital tools to enhance risk assessment, monitoring, and reporting.

- Integrating risk with strategy: Embedding risk considerations into the formulation and execution of business strategies to align operational decisions with risk objectives.

- Optimising capital utilisation:Ensuring that capital is effectively deployed to achieve an optimal balance between

risk and return. - Enhancing risk communication: Strengthening communication channels to ensure a shared understanding of risks across all organisational levels.

- Promoting stakeholder trust: Demonstrating robust risk governance to maintain confidence among stakeholders, including investors, customers, and regulators.

Key challenges to risk oversight in 2024

- Challenges in addressing Environmental, Social, and Governance (ESG) risks and Climate Risk assessment: The increasing global and local focus on ESG factors presents significant challenges for the banking sector. Sri Lankan banks face hurdles in developing and integrating robust climate risk assessment frameworks, as these frameworks are still in their infancy. The absence of established benchmarks and the need for significant investments in tools, expertise, and systems further compound these challenges.

- Aligning with global ESG standards and opportunities in sustainable finance: Simultaneously, heightened regulatory expectations for ESG compliance drive the need for structured climate finance strategies. The Bank is proactively aligning with SLFRS S1 & S2 reporting standards, expanding its green finance portfolio, and developing sustainability-linked credit products. Key initiatives include implementing a Climate Risk Assessment Framework, developing a Climate Transition Plan, conducting stress-testing for ESG factors, and fostering stakeholder engagement. By embedding ESG principles into core lending and investment decisions, the Bank aims to mitigate regulatory and reputational risks while positioning itself as a leader in sustainable finance.

- Climate risk integration in credit and stress-testing: Given Sri Lanka’s vulnerability to natural disasters, integrating climate risk into credit evaluation processes and stress-testing is becoming a priority. The Bank is planning to commence climate-related stress-testing in 2026, which will involve assessing the potential financial impacts of extreme weather events on borrowers and the portfolio. This integration requires the development of robust methodologies, access to reliable environmental data, and training for risk management professionals to interpret climate-related risks effectively.

- Infrastructure and expertise gaps in digitisation: While the banking industry is accelerating its digital transformation, gaps in digital infrastructure, limited expertise, and slow adoption rates present significant challenges. Collaborative efforts with the Bank’s Data Science Team of the IT Research & Development Unit and external consultants are crucial to bridge these gaps. This journey highlights the need for continuous skill development within the IRMD as well as among the stakeholder departments and units and alignment across departments to achieve meaningful digital transformation.

- Heightened regulatory requirements: Stricter regulatory requirements regarding compliance, corporate governance, capital adequacy, liquidity management, and sustainability are expected to intensify over the next 2–3 years. Banks will be required to allocate substantial resources to meet these evolving demands. This includes implementing governance and risk frameworks that align with both local and international regulations. Adhering to these requirements while managing costs and operational efficiency will be a significant balancing act for the Bank.

- Cybersecurity risks and data protection: The banking sector faces an escalating threat from cyberattacks and data breaches, necessitating continuous investments in robust cybersecurity frameworks. The Bank prioritises the protection of customer and institutional data through multi-layered security measures. Proactive cybersecurity initiatives include periodic vulnerability assessments/penetration testing, independent security assessments, and ongoing employee training to reinforce cyber hygiene practices. The Bank also ensures strict adherence to CBSL directives and global cybersecurity standards, including ISO/IEC 27001 and Payment Card Industry Data Security Standards (PCI DSS), further strengthening its resilience against evolving cyber threats.

- Talent acquisition and retention challenges: The demand for skilled risk professionals with up-to-date knowledge in relevant technologies is growing, both locally and globally. Attracting and retaining such talent is becoming increasingly challenging owing to scarcity, especially as specialised skills like ESG risk analysis, cybersecurity, and data analytics. The Bank is on a journey of nurturing internal talent while positioning itself as a preferred employer to attract external expertise.

- Rising operational costs and efficiency pressures: The transformation of legacy risk management processes into digital formats is already underway with the collaborative support of stakeholder units as well as through the services of external consultants. However, optimising resource allocation, leveraging automation, and ensuring cost efficiency remain ongoing challenges.

- Technological obsolescence: Rapid advancements in technology demand continuous upgrades to systems and processes. Falling behind on technological adoption could affect operational resilience and the ability to compete in an increasingly digitalised banking landscape.

Key risk management initiatives adopted in 2024

- Digital transformation in risk management: The IRMD has taken significant strides in digitizing risk management processes. Initiating the implementation of a Risk Data Repository and Data Marts, the Department is on a transformative journey. These initiatives aim to streamline risk management activities, enhance internal governance, and drive greater operational efficiency, consistency and alignment across departments.

- Integration of environmental and social risks: Recognising the importance of environmental and social factors, the Bank has incorporated these risks into its Internal Capital Adequacy Assessment Process (ICAAP). This enhancement enables improved evaluations of potential impacts through internally developed stress-testing methodologies.

- Enhanced application of Risk Adjusted Return on Capital (RAROC): Strengthening credit risk evaluation, the Bank has externally validated its RAROC assessment methodologies and processes, ensuring adherence to global best practices and reinforcing its commitment to prudent risk management.

- Integrating climate risk governance: The Bank is aligning with global standards by embedding climate risk governance, scoring, and data-driven disclosures into its Risk Management Framework. This initiative enhances the Bank’s resilience to climate related risks, ensures compliance with evolving regulatory requirements, and promotes long-term sustainable growth.

- Commitment to customer centricity: Comprehensive internal training and knowledge sharing programs were conducted for Branch Managers and Credit Analysts. These sessions covered credit risk analysis, ECL assessment of Individually Significant Customers (ISCs) and environmental and social considerations, equipping stakeholders with essential expertise.

- Strengthened credit risk review process: The Credit Risk Review (CRR) mechanism has been enhanced, resulting in improved identification of potential credit deteriorations and minimised delinquencies. This progress is driven by the expansion of the centralised online oversight system, which now encompasses additional lending units and provides the IRMD with a growing wealth of timely and actionable risk insights, strengthening operational efficiency and decision making.

- Expansion of ECL review practices: The IRMD has enhanced its independent review of ECL assessments for ISCs. This enhancement expands coverage to encompass all lending units within the Bank's domestic and Bangladesh operations. The expanded scope has resulted in demonstrably improved consistency and accuracy of ECL assessments, coupled with enhanced coordination with lending units.

- Revision of threshold limits: In light of improving economic conditions and a healthy portfolio, and with Board approval, the Bank has adjusted the threshold limits for credit proposals reviewed by the IRMD, coupled with differentiated threshold framework for credit proposals, predicated on validated internal credit risk rating models. This revision reflects the Bank's responsiveness to market dynamics and the commitment to achieve optimised resource allocation and enhanced operational efficiency. Critically, the IRMD maintains a strong focus on significant credit exposures, ensuring rigorous oversight even with adjusted thresholds.

- The Risk Elevated Industry (REI) assessment process: Encompassing both initial assessments and subsequent reviews for credit facility upgrades, has been centralised and entrusted to the IRMD. This centralisation enhances efficiency, eliminates operational burden from Lending Officers, and ensures improved accuracy, consistency, and expedited processing of these critical risk assessments.

- Integration of technology risk into Risk and Control Self Assessment (RCSA) Framework: Broadening its risk management scope, the IRMD has successfully integrated technology risk into the Risk Control Self-Assessment framework, enhancing the Bank's resilience to technological vulnerabilities.

- Pursuit of ISO 22301:2019 certification: To align with global best practices in Business Continuity and Disaster Recovery, the Bank has engaged external expertise to achieve ISO 22301:2019 certification. This underscores its commitment to operational excellence and organizational sustainability.

- Introduction of Technology Risk Framework and setting up steering committee: This is in tandem with the rapid embracing of new technologies into the Bank’s ecosystem as a balancing act that helps the Bank in managing the relatively new risk vistas it may get exposed in the new digital era.

- Strengthening Data Governance: Data Breach Handling Policy and Procedure were implemented to strengthen and enhance the Bank’s overall Data Governance Policy Framework, in accordance with the Personal Data Protection Act 09 of 2022.

Details of the specific activities undertaken by the Board Integrated Risk Management Committee (BIRMC) during the year to strengthen risk governance and management are given in its report on pages 218 and 220 of this Annual Report.

Risk Appetite and Risk Profile

The Board-approved Risk Appetite Statement (RAS) sets the strategic parameters for risk-taking, defining acceptable risk thresholds and guiding capital allocation decisions. This framework outlines:

- Quantitative risk limits: Preferred asset quality ratios, market risk thresholds, and capital adequacy buffers

- Qualitative risk parameters: The Bank’s stance on reputational, strategic, and compliance risks

- Dynamic risk considerations: Real-time adjustments based on macroeconomic trends and stress-testing outcomes

The RAS is continuously reviewed against emerging market dynamics, regulatory shifts, and stress scenario assessments, ensuring that the Bank remains well-capitalised and resilient under varying economic conditions.

The risk management function provides regular updates to the Management, BIRMC, and the Board through detailed reports, including Key Risk Indicators (KRIs) and a comprehensive Risk Profile Dashboard. These updates enable continuous monitoring of the Bank’s risk profile, ensuring that it remains within the approved risk appetite. Prompt corrective actions are taken to address any deviations, safeguarding the Bank's adherence to established risk limits.

The Bank’s risk profile is anchored in its strong capital adequacy and liquidity positions, which determine its capacity to manage risks effectively. It is characterised by a portfolio of high-quality assets and a stable, diversified funding base across geographies, sectors, products, currencies, sizes, and tenors. A detailed comparison of the risk profile of the Bank’s Sri Lankan operations as of December 31, 2024, and December 31, 2023, against the defined risk appetite and regulatory or Board-approved policies is given below.

Risk profile Table – 50

| As at December 31, | ||||

| Risk category | Key Risk Indicator | Policy parameter | Actual position | |

| 2024 | 2023 | |||

| Credit risk: | 3.05 | 5.85 | ||

| Quality of lending portfolio | Impaired loans Stage 3 ratio (%) | 2 – 5 | ||

| Impairment (Stage 3) to Stage 3 loans ratio (%) | 40 – 45 | 64.61 | 43.22 | |

| Weighted average rating score of the overall lending portfolios to be better than ‘6’ (%) | 35 – 40 | 80.35 | 80.89 | |

| Concentration | Loans and advances by product – Highest exposure to be maintained as a percentage of the total loan portfolio (%) | 30 – 40 | 35.01 | 35.40 |

| Advances by economic sub sector (using HHI-Herfindahl – Hirschman-index) | 0.015 – 0.025 | 0.0111 | 0.0136 | |

| Exposures exceeding 5% of the eligible capital (using HHI) | 0.05 – 0.10 | 0.0067 | 0.0095 | |

| Exposures exceeding 15% of the eligible capital (using HHI) | 0.10 – 0.20 | 0.0054 | 0.0049 | |

| Exposure to any sub sector out of total loan portfolio to be maintained at (%) | 4 – 5 | 2.74 | 3.18 | |

| Aggregate of exposures exceeding 15% of the eligible capital (%) | 20 – 30 | 16.88 | 15.04 | |

| Cross border exposure |

Rating of the highest exposure of the portfolio on S&P Investment Grade – AAA to BBB- |

AA | AAA | AAA |

| Market risk: | 805.25 | 100.79 | ||

| Interest rate risk | Interest rate shock: (Impact to NII as a result of 100bps parallel rate shock for LKR and 25bps for FCY) (Rs. Mn.) |

Maximum of 2,000 | ||

| Maximum repricing gap (RSA/RSL in each maturity bucket – up to one- year period) (Times) |

<1-1.5 | 0.84 | 0.99 | |

| Liquidity risk | Liquidity Coverage Ratio (LCR) for All Currencies (%) | 100 | 454.36 | 516.27 |

| Net Stable Funding Ratio (NSFR) (%) | 100 | 187.29 | 193.70 | |

| Foreign exchange risk | Exchange rate shocks on Total FCY exposure (at 1% exchange rate sensitivity) (Rs. Mn.) | 750 | 562.68 | 602.23 |

| Operational risk | Operational loss tolerance limit (as a percentage of last three years average gross income) (%) |

3 – 5 | 0.504 | 0.226 |

| Strategic risk: | Capital adequacy ratios: | 14.227 | 11.442 | |

| CET 1 (%) | Over 8.5 | |||

| Total capital (%) | Over 14.0 | 18.142 | 15.151 | |

| ROE (%) | Over 15.0 | 22.06 | 9.78 | |

| Creditworthiness – Fitch Rating | AA(lka) | A(lka) | A(lka) | |

(RSA – Rate Sensitive Assets, RSL – Rate Sensitive Liabilities)

Credit rating

Fitch Ratings upgraded the National Long-Term Ratings of ten Sri Lankan banks, including our Bank, following the recent sovereign upgrade and the recalibration of the agency’s Sri Lankan National Rating Scale. As part of this process, our Bank’s National Long-Term Rating was upgraded to AA-(lka) from A(lka), effective January 21, 2025. The recalibration of Sri Lanka’s National Rating Scale was prompted by Fitch’s upgrade of Sri Lanka’s Long-Term Local-Currency Issuer Default Rating (IDR) to “CCC+” from “CCC” on December 20, 2024.

This upgrade reflects the Bank’s strong credit fundamentals and resilience amidst a stabilizing macroeconomic environment. The improved sovereign credit profile and recalibrated rating scale have further bolstered the risk profile of the Sri Lankan banking sector. Stable Outlook highlights the Bank’s ability to navigate the current operating environment while maintaining robust financial performance and a solid capital base.

Roadmap for 2025 and beyond

The Bank’s strategic risk outlook for 2025 and beyond is shaped by an evolving economic and regulatory landscape, necessitating a resilient and adaptive risk management framework. The IRMD has outlined three transformative priorities to enhance risk governance and drive sustainable growth:

- Value addition to decision making through digitisation (i.e. provision of robust risk insights via digital platforms for effective business decision making).

- Internal customer experience (i.e customer centricity through continuous process improvements).

- Enhancement of ESCR function into value creation (i.e. forerunner among peers from an ESCR perspective).

By embedding sound risk analytics, fostering a culture of agility, and reinforcing ESG-driven risk frameworks, the Bank is positioning itself for future-ready risk governance that supports its growth and sustainability ambitions.

To achieve these objectives, the IRMD will undertake a series of strategic initiatives designed to strengthen the risk management framework:

- Serving internal customer demands by providing granular risk insights, prioritised through digital platforms.

- Expanding the existing CRR function to transform it to a digitised process to assist line Management and Lending Officers in making swift credit decisions.

- Increased automated operational risk monitoring and operational risk best practices.

- Automated processes for liquidity level monitoring.

- Increasing IT Risk Management coverage to capture the risks associated with emerging technologies.

- Risk leadership to new business models/initiatives of the Bank.

- Inclusion of risk management and governance to the Bank’s equity investment portfolio.

- Risk management of Bank’s digital channels in order to secure customers’ digital journey with the Bank.

- Integrate climate risk governance, scoring, and data-driven disclosures, into Bank’s existing risk management framework to enhance resilience, regulatory compliance, and sustainable growth.

By pursuing these initiatives, the IRMD aims to strengthen its capabilities and deliver on its commitment to proactive risk management. These efforts will enhance resilience to future uncertainties, improve regulatory compliance, and align with the Bank’s vision of fostering sustainable growth in a rapidly changing environment.

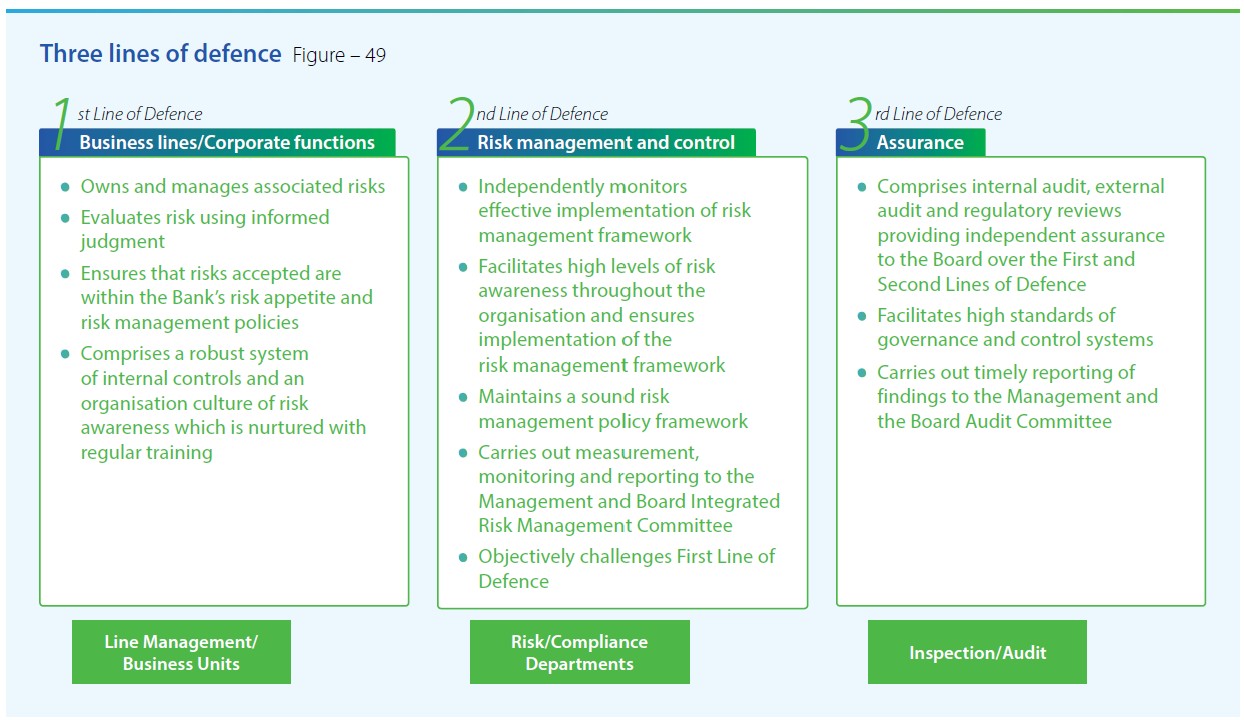

Risk Management Framework

The Bank’s Integrated Risk Management Framework (IRMF) is a robust and comprehensive structure designed in accordance with CBSL guidelines and based on the internationally recognised Three Lines Model. This framework delineates the specific roles and responsibilities of various departments within the Bank, ensuring a coordinated and effective approach to managing risks.

The IRMF encompasses all risk exposures through a structured methodology supported by well-defined organisational structures, advanced systems, efficient processes, and globally benchmarked best practices. It provides a systematic approach to identifying, mitigating, and addressing potential risks, uncertainties, and losses faced by the Bank.

By adhering to the Three Lines model, the framework balances operational responsibilities while equipping the Bank with specialised skills and tools to manage risks effectively. The IRMF undergoes an annual review or is updated more frequently as needed to reflect changes in regulatory requirements, operational dynamics, and the evolving risk landscape.

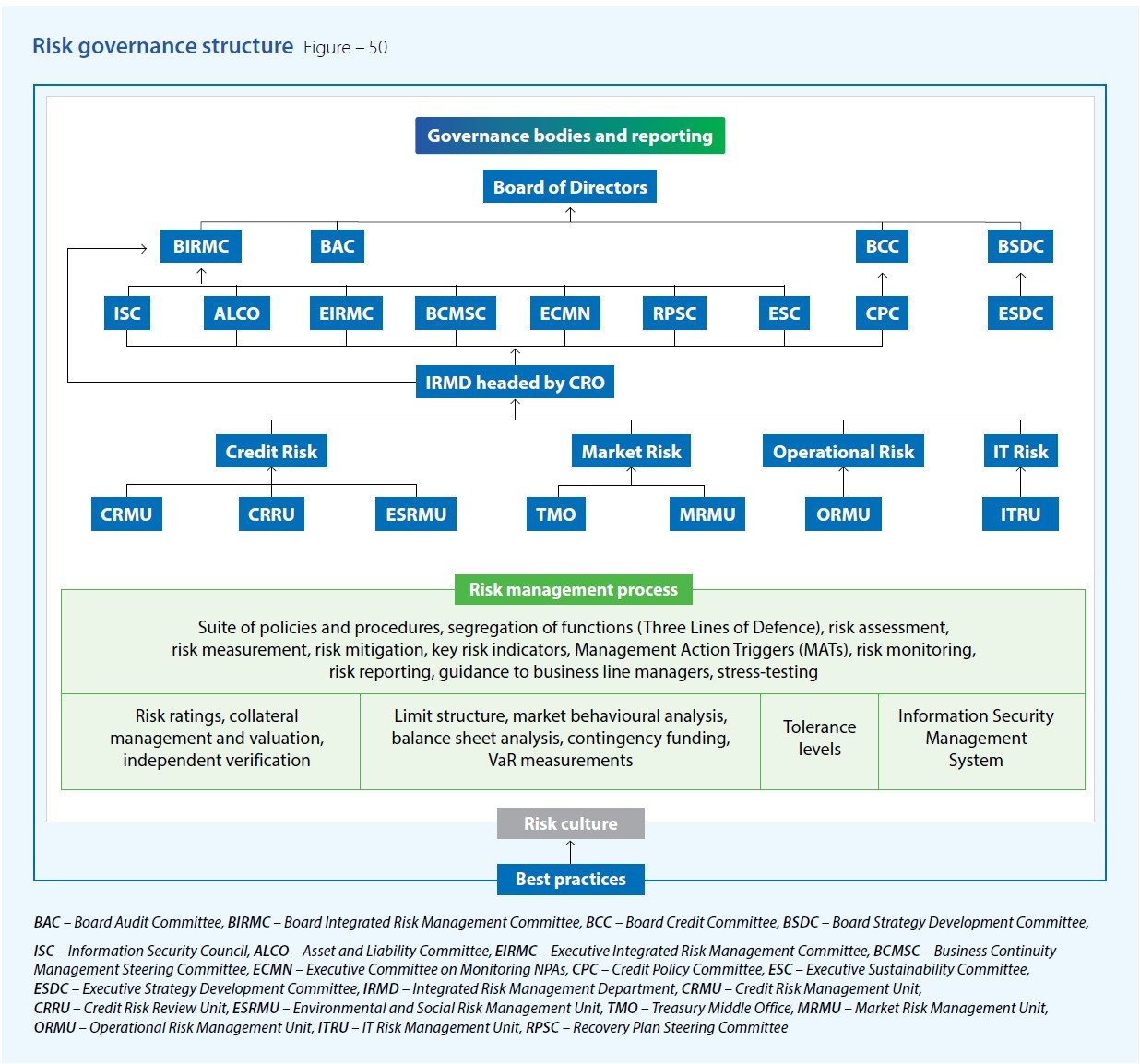

Board of Directors

The Board of Directors functions as the highest governing authority, responsible for formulating the Bank’s strategies and policies, setting objectives, and overseeing executive operations. It holds the ultimate accountability for supervising the risks undertaken by the Bank and its Group entities, ensuring these are effectively identified and managed. (Refer for detailed profiles of the Board of Directors.)

The Board defines the Bank’s risk appetite by maintaining a balance between achieving strategic objectives and managing the risks associated with pursuing those objectives. Oversight responsibilities are delegated to various Board committees, listed on page 197, which are supported by executive-level counterparts. These committees work in close collaboration with the executive management to assess the effectiveness of the Bank’s risk management framework. They regularly report their findings to the Board, offering a comprehensive perspective on the Bank’s risk profile, management actions, and outcomes. This process enables the Board to identify risk exposures, address gaps, and implement mitigation measures in a timely manner.

The Board actively guides executive management to ensure that business strategies and objectives are aligned with the desired risk levels. The leadership and ethical tone set by the Board, combined with its strong corporate culture, are instrumental in managing risks effectively throughout the Bank.

In addition to adhering to the Three Lines Model, the Bank places a strong emphasis on ethical conduct as a core element of risk management. The Bank’s commitment to responsible, transparent, and disciplined business practices is clearly outlined in various policies and frameworks, including the Code of Ethics, Gift Policy, Communication Policy, Credit Policy, Anti-Bribery and Anti-Corruption Policy, and Conduct Risk Management Policy Framework. These documents set clear expectations for all employees to uphold the highest standards of honesty, integrity, and accountability.

The Board also ensures diligent oversight of the risk profiles of all subsidiaries within the Group, in addition to that of the Bank, recognising the potential financial and reputational risks involved. This oversight is conducted in strict compliance with regulatory requirements. (Refer Group structure for the list of subsidiaries.)

Board committees

The Board has established four dedicated committees to support its oversight responsibilities for risk management and to ensure the adequacy and effectiveness of the Bank’s internal control systems. These committees are:

- Board Audit Committee (BAC)

- Board Integrated Risk Management Committee (BIRMC)

- Board Credit Committee (BCC)

- Board Strategy Development Committee (BSDC)

Each committee functions under clearly defined Terms of Reference (ToR) and convenes meetings at predetermined intervals or as required. Through their discussions and evaluations, these committees provide recommendations to the Board on critical areas such as risk appetite, risk profile, strategy, risk management and internal control frameworks, risk policies, limits, and delegated authority.

For detailed information on the composition, Terms of Reference, authority, meeting schedules, attendance, activities undertaken during the year, and other relevant aspects, please refer to the respective committee reports.

Executive committees

The executive management is responsible for implementing strategies and plans as mandated by the Board of Directors while ensuring that the Bank’s risk profile remains within the approved risk appetite. The Executive Integrated Risk Management Committee (EIRMC), composed of members from units overseeing credit risk, market risk, liquidity risk, operational risk, and IT risk, leads this effort. To address specific risk areas comprehensively, the EIRMC is supported by several dedicated committees, facilitating effective risk management across both the First and Second Lines of Defence:

- Asset and Liability Management Committee (ALCO)

- Credit Policy Committee (CPC)

- Executive Committee on Monitoring Non-Performing Credit Facilities (ECMN)

- Information Security Council (ISC)

- Business Continuity Management Steering Committee (BCMSC)

- Executive Sustainability Committee (ESC)

- Recovery Plan Steering Committee (RPSC)

The EIRMC maintains active communication with the BIRMC to ensure that risk management activities align with the IRMF and that risks are managed within established parameters. The Chief Risk Officer (CRO) directly reports to the BIRMC, underscoring the independence of the risk management function. Details regarding the composition of the executive committees can be found in the “Annual Corporate Governance Report” on pages 201 and 203.

The CRO, who heads the IRMD, plays a pivotal role in ensuring risk governance by participating in major risk and control forums, including meetings of the BIRMC, BCC, and BAC. The IRMD is entrusted with independently monitoring the compliance of the First Line of Defence with established policies, procedures, guidelines, and limits. Any deviations are escalated to the relevant executive committees for further action.

Further, the IRMD provides a holistic view of all types of risk, enabling independent risk assessments by the executive committees. The findings and recommendations are shared with Line Managers and Senior Management, fostering effective communication, promoting discussions, and driving necessary actions to mitigate risks and enhance the Bank’s resilience.

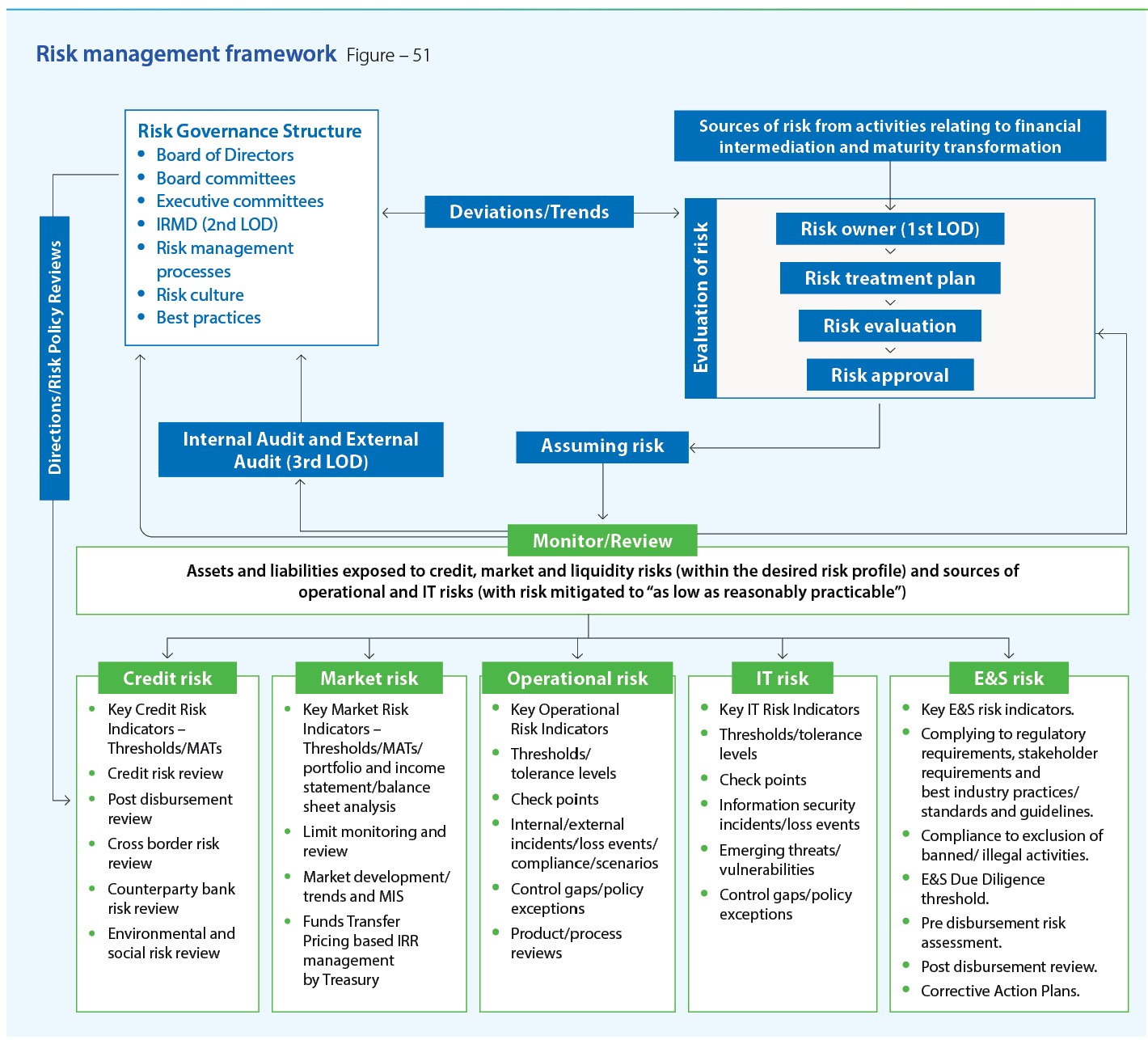

Risk management

Risk management involves the critical responsibility of identifying, assessing, controlling, and mitigating risks. This includes developing and implementing risk mitigation strategies, monitoring Early Warning Signals (EWS), estimating potential future losses, and taking proactive measures to manage or transfer risks effectively. The Bank’s risk management framework (depicted in Figure 51) serves as a guide for designing and executing risk management strategies, policies, and procedures, ensuring alignment with the strategic priorities outlined in the Bank’s Corporate Plan and its defined risk appetite.

To enhance its risk detection and management capabilities, the Bank has made significant investments in developing a robust infrastructure. This infrastructure includes foundational resources such as policies, procedures, guidelines, circulars, limits, software platforms, risk assessment tools, databases, and expertise. Additionally, the Bank has implemented risk dashboards and predictive modeling capabilities to support real-time monitoring and decision-making. These elements are complemented by incident response mechanisms, advanced data analytics, and streamlined communication channels, all aligned with international best practices to ensure the effectiveness of risk management processes.

This infrastructure establishes the foundation for applying specific risk management tools, enabling the Bank to proactively identify, assess, and manage risks while ensuring regulatory compliance and operational resilience.

Recognising that risk management is a shared responsibility across the organisation, the Bank emphasises the importance of equipping all employees with a clear understanding of the risks they may encounter. The IRMD plays a key role in fostering a strong risk culture by providing continuous training and awareness programs. These initiatives focus particularly on risk owners, offering knowledge and skill-building opportunities to ensure that all employees are well-prepared to address risks effectively and contribute to the Bank’s overall resilience.

Policies, procedures, and limits

The Bank has implemented a comprehensive suite of risk management policies that address all managed risks, ensuring robust governance and regulatory compliance. These policies provide clear guidance to business and support units on managing risks effectively and adhering to regulatory requirements, including the Banking Act Direction No. 07 of 2011 – Integrated Risk Management Framework for Licensed Commercial Banks, developed in alignment with the Basel Framework, as well as subsequent directives issued by the CBSL.

By institutionalising a structured knowledge base, these policies aim to minimise bias and subjectivity in risk-related decision-making. Core documents, such as risk management policies, play a critical role in shaping the Bank’s risk culture by clearly defining objectives, priorities, processes, and the roles and responsibilities of the Board of Directors and the Management in risk governance.

The Risk Appetite Statement (RAS) is a key element of the Bank’s risk management framework, establishing the limits within which risks must be managed. The RAS is reviewed and updated by the BIRMC and the Board of Directors at least annually or more frequently, in line with evolving regulatory and business requirements.

To ensure the Bank’s overall risk exposure, including that of its international operations, aligns with CBSL’s regulatory framework, the Bank considers the regulatory landscapes in all jurisdictions where it operates. Operational guidelines are issued to facilitate the implementation of the Risk Management Policy and ensure compliance with the limits outlined in the RAS. These guidelines provide employees with detailed instructions on the types of facilities, processes, and terms and conditions that govern the Bank’s daily operations.

Risk management tools

Building on its comprehensive infrastructure, the Bank employs a diverse range of qualitative and quantitative tools to identify, measure, manage, and report risks effectively. These tools are tailored to address specific risks based on factors such as the likelihood of occurrence, potential impact, and data availability.

Key tools utilised by the Bank include EWS, threat analysis, risk policies, risk registers, risk maps, and RCSA. These tools are complemented by advanced frameworks like the ICAAP, workflow-based operational risk management systems, and the Environmental and Social Management System (ESMS).

To enhance risk quantification and mitigation, the Bank employs diversification strategies, insurance, benchmarking, gap analysis, and Net Present Value (NPV) analysis. Additionally, advanced products such as SWAPs, Caps and Floors, hedging and techniques like risk scoring, stress-testing, duration analysis, Value at Risk (VaR) assessments , and scenario analysis are integral to managing market and credit risks.

These tools and techniques collectively ensure that risks across all dimensions of the Bank’s operations are managed effectively within the parameters of its risk appetite and governance frameworks.

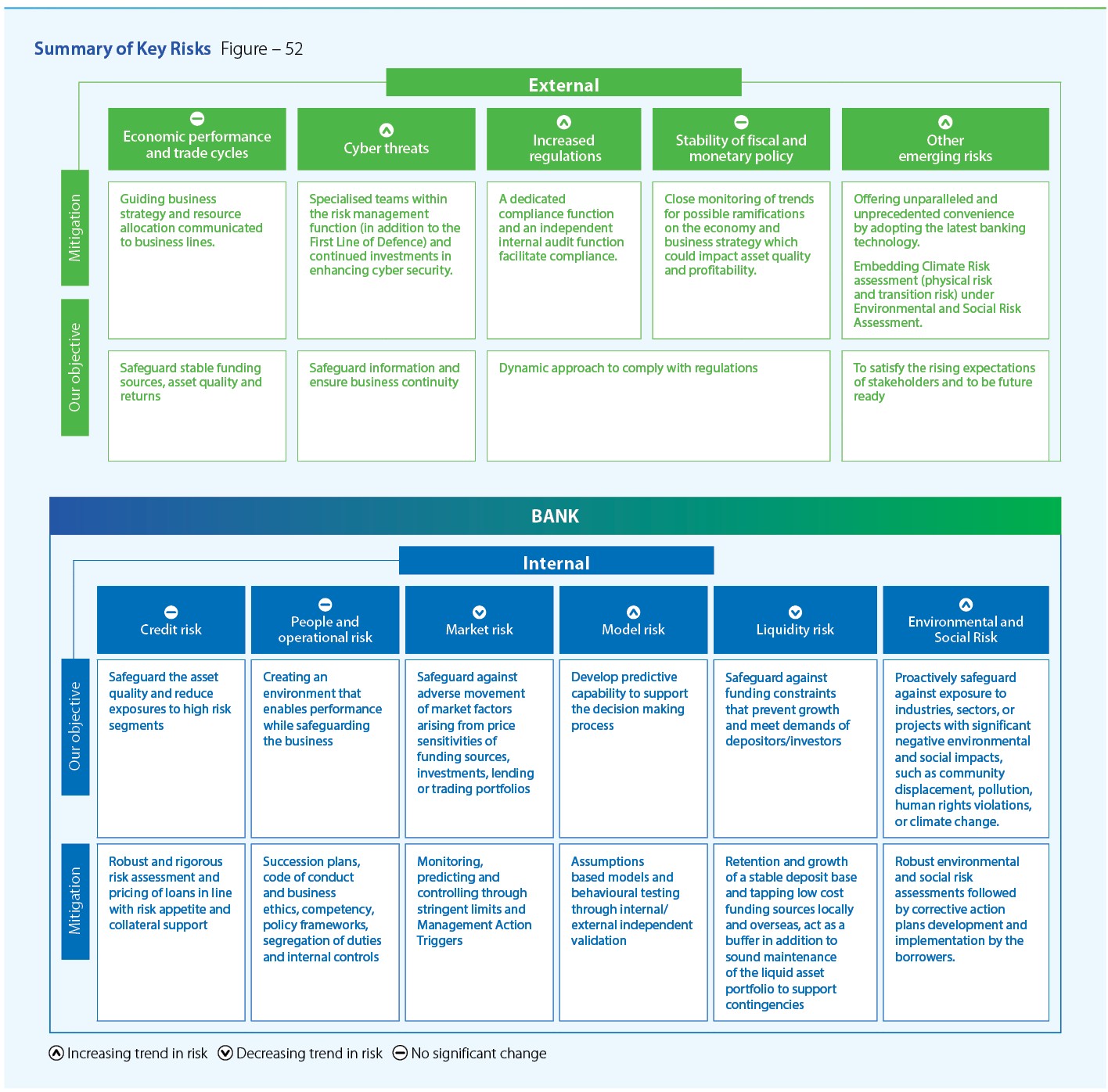

Types of risks

The Bank is exposed to a wide spectrum of financial and non-financial risks, which are broadly categorised into credit, market, liquidity, operational, reputational, IT, strategic, environmental and social, and legal risks. Collectively, these risks define the Bank's overall risk profile, which is consistently monitored against the established risk appetite. To prudently manage these risks, the Bank has implemented a comprehensive risk management framework. However, despite these measures, external and internal factors continue to introduce substantial uncertainty, requiring constant vigilance and adaptability to navigate an evolving risk landscape.

External factors

- Macroeconomic and political risks: Fluctuations in macroeconomic variables, political instability, changes in fiscal and monetary policies, sovereign risk destabilising financial markets, demographic shifts.

- Market and trade risks: Fragile supply chains, pandemics, sustainability concerns, competitive pressures, declining property valuations, credit rating downgrades.

- Technological and regulatory risks: Technological advancements, regulatory developments, stakeholder demand for ethical practices.

- Reputational risks: Social media misinformation, heightened public scrutiny, unfounded perceptions of banks exploiting customers.

- Contagion Risk : Interconnectedness of banking ecosystem, companies, economies that can have cascaded impact on the business sustainability.

Internal factors

- Workforce and culture: High staff turnover, knowledge and skill gaps, industrial disharmony, deterioration in internal sub-cultures.

- Governance and strategy: Arbitrary decision-making, misalignment of strategy, lapses in risk framework implementation, inaccurate macroeconomic predictions, improper alignment of remuneration to performance and risk.

- Process and Data Risks: Execution gaps, weak data infrastructure hindering decision-making, inadequate digitization, inaccuracies in risk reporting, acts of fraud, misappropriation, or unethical behaviour.

- Customer and strategy risks: Provision of incorrect advice to customers, strategic misalignments, underperformance of group companies.

Navigating in an increasingly complex environment

The Bank operates in an environment marked by increasing complexity and uncertainty, driven by emerging threats and challenges to traditional assumptions about markets, competition, and fundamental business principles. To address these challenges, the Bank emphasises on:

- Gaining a deeper understanding of stakeholder needs.

- Ensuring excellence in internal process execution.

- Leveraging strategic responses to risks as opportunities to enhance its value proposition and foster future growth.

These efforts ensure that discussions on risk management remain a top priority in all Board, Board Committee, and Executive Committee meetings. A summary of key risks is given in Figure 52 on page 262.

By adopting a consistent approach to risk management and addressing uncertainties effectively, the Bank strives to implement its strategy to deliver value for all stakeholders. A detailed account of the various types of risks managed by the Bank and the corresponding mitigation measures is given below.

Credit risk

Credit risk refers to the potential financial loss arising from a borrower or counterparty’s failure to meet their contractual obligations. The Bank is exposed to credit risk through its direct lending activities as well as commitments and contingencies. The extent of credit risk is influenced by several factors, including the quality and the diversification of the lending portfolio, the concentration of exposures, the credit ratings of counterparties with international exposure, and sovereign ratings related to government exposures.

The marked improvement in the macroeconomic and operating environment during the year, driven by stabilising socio-economic and political conditions, contributed to an enhancement in overall asset quality across the financial sector. This positive shift has provided the Bank with opportunities to refine its credit risk management practices. While challenges persist in certain sectors, the Bank has leveraged the improved conditions to adopt forward-looking strategies for managing and mitigating credit risk, ensuring a balanced and resilient approach to risk management.

The Bank’s total credit risk is composed of three key elements: counterparty risk, concentration risk, and settlement risk. These components are monitored and managed under the Bank’s comprehensive risk management framework to ensure a proactive and resilient approach to credit risk mitigation.

Maximum credit risk exposure Table – 51

| As at December 31, | 2024 | 2023 | ||

| Rs. Bn. | % | Rs. Bn. | % | |

| Net carrying amount of credit exposure: | ||||

| Cash and cash equivalents | 86.848 | 2.6 | 157.819 | 5.2 |

| Placements with central banks and other banks (excluding reserves) | 104.901 | 3.2 | 86.248 | 2.9 |

| Financial assets at amortised cost – Loans and advances to Banks | ||||

| Financial assets at amortised cost – Loans and advances to Other Customers | 1,384.524 | 42.1 | 1,176.360 | 38.9 |

| Financial assets at amortised cost – Debt and other financial instruments | 667.709 | 20.3 | 649.740 | 21.5 |

| Financial assets measured at fair value through other comprehensive income | 301.584 | 9.2 | 287.023 | 9.5 |

| Total (a) | 2.545.566 | 2,357.190 | ||

| Off-balance sheet maximum exposure: | ||||

| Lending commitments | 196.131 | 6.0 | 157.205 | 5.2 |

| Contingencies | 546.359 | 16.6 | 507.169 | 16.8 |

| Total (b) | 742.490 | 664.374 | ||

| Total of maximum credit exposure (a + b) | 3,288.056 | 100.0 | 3,021.564 | 100.00 |

| Gross carrying amount of loans and advances to Other Customers | 1,486.900 | 1,265.559 | ||

| Stage 3 (credit impaired) loans and advances to Other Customers | 127.738 | 143.564 | ||

| Impaired loans as a % of gross loans and advances to Other Customers | 8.6 | 11.3 | ||

| Allowance for impairment – loans and advances to Other Customers | 102.376 | 89.199 | ||

| Allowance for impairment as a % of gross loans and advances to Other Customers | 6.9 | 7.0 | ||

| Impairment charge – loans and advances to Other Customers | 22.816 | 5.690 | ||

Amidst the improving socio-economic conditions in the country, the maximum credit exposure of the Bank increased to Rs. 3,288.06 Bn. as of December 31, 2024 (compared to Rs. 3,021.56 Bn. as of December 31, 2023).

With the improving macroeconomic environment, the financial services industry witnessed a relative stabilization in the trend of loans and advances categorised as Non-Performing Credit Facilities (NPCF). Consequently, the credit-impaired (Stage 3) loans and advances to customers of the Bank stood at Rs. 127.74 Bn. as of December 31, 2024 (compared to Rs. 143.56 Bn. in 2023), constituting 8.6% of gross loans and advances to customers (compared to 11.3% in 2023). The Bank has made a cumulative impairment provision of Rs. 102.38 Bn. on the loans and advances portfolio as of December 31, 2024, in accordance with the requirements of SLFRS 9 (compared to Rs. 89.2 Bn. in 2023).

Additionally, following the successful completion of the debt restructuring program related to Sri Lanka International Sovereign Bonds (SLISBs), the Bank derecognised the existing bonds and reversed the full impairment provision previously held against them. New bonds issued as part of the restructuring were subsequently recognised, with the required provisions for impairment and day-one loss accounted for in accordance with applicable standards.

Managing credit risk

The lending portfolio constituted 53.3% of the Bank’s total assets as at December 31, 2024, with credit risk accounting for over 88.12% of the total risk-weighted assets. Recognising this significant exposure, the Bank places utmost importance on prudently managing credit risk, going beyond regulatory compliance. This focus is governed by a Board-approved credit risk management framework, encompassing a robust governance structure and a comprehensive suite of risk management processes. These include policies and procedures, risk assessments, collateral management, credit risk segregation, environmental and social risk management, independent verifications, ongoing monitoring, post-disbursement reviews, guidance to business managers, credit risk knowledge dissemination, and the integration of internal audit information.

During 2024, supported by the improved socio-economic environment, the EIRMC/BIRMC continued to address credit risk management with diligent oversight mechanisms. The top 5 Stage 3 customers in each subsector remained under close surveillance. Leveraging insights from the EWS system, the Bank meticulously tracked the movements of exposures and the number of customers categorised as EWS Watch List, Cautious Care, and Intensive Care. Continuous monitoring of stressed lending assets identified through EWS was conducted in collaboration with Lending Officers and the IRMD. The IRMD independently reviewed impairment of Individually Significant Customers quarterly, with plans underway to enhance this process further through technology for improved accuracy and efficiency in 2025.

Despite the improved macroeconomic conditions, the Bank continued to maintain significant attention on its exposures to REIs while closely monitoring the Expected Credit Loss (ECL) for individually and collectively impaired facilities in Stage 2 and Stage 3 categories. Separate analyses and monitoring processes were undertaken for tourism-related and other exposures, with the top 10 borrowers in each REI category within Stage 2 and Stage 3 under close observation. The Bank also paid close attention to its exposures to the Government, both in terms of commercial lending and treasury guarantees, while tracking the concentration of collateral in its advances.

The Bank has established internal limits to manage credit exposure effectively, including but not limited to:

- Open credit exposure

- Aggregate credit exposures to corporate borrowers owned or controlled by a single common shareholder or stakeholder

- Related party exposures

- Economic group exposure ratios

- Cross-border exposures

Post-disbursement credit reviews for loans and overdrafts were conducted in line with the “Credit Risk Review Policy”. These reviews aligned with the provisions outlined in the Credit Policy and Lending Guidelines. Findings were communicated to Lending Officers, whose responses were subsequently assessed. Particular attention was given to lending units or regions with elevated stress levels, with detailed analyses escalated to the Executive Committees for prompt action.

Credit health checks for branches and other lending units assessed various parameters, including credit evaluation processes, account behaviour, risk ratings, compliance with guidelines, post-sanction compliance, concentration levels in the Loan Book, recovery efforts, follow up on NPCF, examination of problematic advances, adherence to credit processes, and the reporting system.

Review of credit risk

The notable turnaround in the operating environment during the year contributed to the revival of credit growth in the private sector and supported moderate economic activity. The Bank demonstrated resilience during this recovery period and managed to secure a proportionately higher share of this growth when the loan book grew by 17.49%. At the same time, there was a notable improvement in asset quality too as evidenced by the gross Stage 3 loans and advances ratio falling to 8.6% by year end compared to 11.3% a year ago.

The robust credit risk management framework guided the Bank in onboarding new exposures and monitoring the quality of the loan book, ensuring the selection of customers, products, industries, and geographies aligned with the Bank’s risk appetite. Strategic initiatives implemented during the year to mitigate credit risks and maintain credit quality are detailed in the Report of the Board Integrated Risk Management Committee on pages 218 to 220.

Concentration risk

The Bank actively mitigates concentration risk through strategic diversification across various dimensions, including industry sectors, products, counterparties, and geographies. The RAS has established specific limits for these segments, ensuring compliance, and exposure monitoring is conducted by the CPC, the EIRMC, the BIRMC and the Board. These committees not only oversee concentration risk exposures but also provide recommendations and propose adjustments to defined limits in response to emerging trends and changes in the business environment.

During the year, the CBSL issued new Directions on large exposures for licensed banks as a macroprudential measure to mitigate systemic risks arising from potential credit concentration. These Directions aim to enhance the safety and soundness of the banking sector and preserve public confidence. One key provision under these Directions requires that, effective January 1, 2026, the maximum limit on large exposures to an individual borrower or a group of connected borrowers must not exceed 25% of the licensed bank’s Tier I capital at any given time.

In response to this regulatory requirement, the Bank extensively deliberated at both the executive and Board committee levels on the measures needed to ensure compliance with the new exposure caps. These discussions emphasised the importance of timely and proactive adjustments to the Bank’s credit exposure strategies to meet the requirements while maintaining a balanced and diversified portfolio.

For a detailed view of the Bank’s exposure management, Graph 48 illustrates the composition of the portfolio of total loans and advances to other customers by tenure, in alignment with the Bank’s defined risk appetite and regulatory guidelines.

Tenure-wise loans & advances to other customers as at December 31, 2024 (based on residual maturity) Graph – 48

Distribution of Stage 3 credit impaired loans and advances to other customers Table – 52

| As at December 31, 2024 | |||||

| Industry Category | Stage 3 Loans & Advances Rs.'000 |

Cumulative provision for Individual Impairment Rs.'000 |

Cumulative provision for Collective Impairment Rs.'000 |

Cumulative provision for Expected Credit Loss Rs.'000 |

Amount Written-off Rs.'000 |

| Agriculture, forestry & fishing | 11,137,842 | 7,249,194 | 1,281,116 | 8,530,310 | 147,608 |

| Arts, entertainment & recreation | 30,128 | 16,914 | 3,242 | 20,156 | 126 |

| Construction | 12,573,601 | 5,629,673 | 1,340,459 | 6,970,132 | 2,951,489 |

| Consumption and others | 5,720,517 | 1,085,751 | 1,838,578 | 2,924,329 | 168,813 |

| Education | 441,492 | 54,181 | 186,091 | 240,272 | 462 |

| Financial services | 1,467,574 | 1,339,133 | 45,391 | 1,384,524 | 10 |

| Health care, social services & support services | 2,380,888 | 1,446,459 | 167,080 | 1,613,539 | 16,418 |

| Information technology and communication services | 1,357,264 | 782,722 | 107,740 | 890,462 | 10,590 |

| Infrastructure development | 2,686,972 | 1,608,457 | 316,291 | 1,924,748 | 199,714 |

| Lending to overseas entities | 10,941,400 | 7,755,263 | 894,861 | 8,650,124 | 0 |

| Manufacturing | 21,726,476 | 13,564,193 | 2,063,106 | 15,627,299 | 723,271 |

| Professional, scientific & technical activities | 1,056,700 | 285,836 | 214,547 | 500,383 | 20,36 |

| Tourism | 21,525,864 | 10,454,967 | 1,266,557 | 11,7215,24 | 33,401 |

| Transportation & storage | 2,212,953 | 1,340,823 | 223,821 | 1,564,644 | 11,096,49 |

| Wholesale & retail trade | 32,478,280 | 18,323,036 | 3,838,016 | 22,161,052 | 202,155 |

| Total | 127,737,951 | 70,936,602 | 13,786,896 | 84,723,498 | 5,565,742 |

Product-wise analysis of loans & advances to other customers as at December 31, 2024 Graph – 49

An analysis of the Bank’s lending portfolio by product (refer to Graph 49) demonstrates the effectiveness of the Bank’s credit policies, ensuring a well-diversified risk distribution across various credit products.

Product-wise geographical analysis of loans & advances to other customers as at December 31, 2024 Graph – 50

The Bank has a relatively high exposure of 36.8% to long-term loans, which is carefully monitored and effectively mitigated through the provision of adequate collateral.

Counterparty risk

The Bank manages counterparty risk through well-defined policies, procedures, and limit structures, including large exposure thresholds and group exposure limits across various products. The Bank has implemented limits that are more stringent than those mandated by regulators, providing enhanced flexibility in managing concentration levels associated with counterparty exposures.

Loans and advances to the Bank from both local and foreign counterparties represent a significant component of counterparty risk. These exposures are closely monitored against established product limits at regular intervals, with dedicated policies, procedures, and limit structures guiding their management.

The financial and economic performance of counterparties is rigorously assessed throughout the year. For exposures to counterparty banks, limits are reviewed and monitored frequently, with adjustments made as necessary to align with the most current information available.

The Bank utilises ratings provided by Fitch Ratings for local banks in Sri Lanka and Credit Ratings Agency Bangladesh (CRAB) for local banks in Bangladesh. Where CRAB ratings are unavailable, equivalent CRISL/Alpha ratings are used. As of December 31, 2024, 97% of the Bank’s exposure to local banks in Sri Lanka was rated in the AAA to A category (refer to Graph 51), while 100% of the exposure to local banks in Bangladesh consisted of AAA to AA-rated counterparties (refer to Graph 52).

The concentration of counterparty bank exposures in Sri Lanka as at December 31, 2024 (Fitch ratings-wise) Graph – 51

The concentration of counterparty bank exposures in Bangladesh as at December 31,2024 (CRAB ratings-wise*) Graph – 52

Cross-border risk

Cross-border risk refers to the potential challenges the Bank may face in receiving payments from customers or third parties due to actions taken by foreign governments, particularly those impacting the convertibility and transferability of foreign currency. Assets exposed to cross-border risk primarily include loans and advances (including exposures acquired through risk participation agreements), interest-bearing deposits with other banks, trade and other bills, and acceptances, which are largely linked to short-term money market activities.

To mitigate risks associated with over-concentration in cross-border exposures, the Bank has established a robust limit structure. It continuously monitors macroeconomic and market conditions in the countries where counterparties are located, rigorously evaluates counterparties, and maintains regular communication with them. When adverse economic or political developments arise in specific countries, the Bank takes timely actions, such as suspending or revising limits, to safeguard its exposures.

The Bank limits its total cross-border exposure to 8% of its total assets (refer to Graph 53). Cross-border exposures span several countries, including the UK, the Maldives, India, Hong Kong, Singapore, and China. Of the Bank’s cross-border exposures related to Sri Lankan and Bangladesh operations, 84.44% are to countries rated AAA to BBB-, while 15.56% are to countries rated below BBB- or unrated (refer to Graph 54).

Cross border exposure of the Bank (Sri Lankan & Bangladesh operations) as at December 31, 2024 Graph – 53

The concentration of cross-border exposure (Sri Lanka and Bangladesh operations) – S&P rating wise as at December 31, 2024 Graph – 54

Market risk

Market risk refers to the potential adverse effects on a bank’s financial position arising from fluctuations in financial market conditions. These conditions include changes in interest rates, exchange rates, commodity prices, equity and debt prices, and the correlations between these variables. Deviations from the assumptions made during decision-making can lead to unexpected financial impacts. The Bank's operations are influenced by these variables and their interdependencies to varying degrees.

Market risk comprises several components, including interest rate risk, liquidity risk, foreign currency risk, and equity risk.

Market risk categories Table – 53

| Major market risk category | Risk components | Description | Tools to monitor | Severity | Impact | Exposure |

| Interest rate | Risk of loss arising from movements or volatility in interest rates |

|||||

| Re-pricing | Differences in amounts of interest-earning assets and interest-bearing liabilities getting re-priced at the same time or due to timing differences in the fixed rate maturities, and appropriately re-pricing of floating rate assets, liabilities, and off-balance sheet instruments | Re-pricing gap limits and interest rate sensitivity limits | High | Medium | Medium | |

| Yield curve | Unanticipated changes in shape and the gradient of the yield curve | Rate shocks and reports | High | High | High | |

| Basis | Differences in the relative movements of rate indices which are used for pricing instruments with similar characteristics |

Rate shocks and reports | High | Medium | Medium | |

| Foreign exchange | Possible impact on earnings or capital arising from movements in exchange rates arising out of maturity mismatches in foreign currency positions other than those denominated in base currency, Sri Lankan Rupee (LKR) |

Risk tolerance limits for individual currency exposures as well as aggregate exposures | Medium | Medium | Medium | |

| Equity | Possible losses arising from changes in prices and volatilities of individual equities |

Mark-to-market calculations are carried out daily for Fair Value Through Profit and Loss (FVTPL) and Fair Value Through Other | Low | Low | Negligible | |

| Commodity | Exposures to changes in prices and volatilities of individual commodities |

Mark to market calculations | Low | Low | Negligible | |

Managing market risk

The Bank effectively manages market risk through a Board-approved market risk management framework. This framework incorporates a robust governance structure and comprehensive risk management processes, including policies, market risk limits, Management Action Triggers (MATs), ongoing risk monitoring, and detailed risk assessments.

To evaluate the impact on the Bank’s Net Interest Income (NII) under stress conditions, scenario analyses were conducted, simulating changes of 100 – 400 basis points (bps) for LKR and 25 – 100 bps for foreign currency (FCY) over a 12-month horizon. Additionally, the Bank employs the Economic Value of Equity (EVE), a long-term measure of Interest Rate Risk (IRR), to analyse its sensitivity to market rate changes and assess its value under current market conditions. The repricing gap between Rate Sensitive Assets (RSA) and Rate Sensitive Liabilities (RSL) was also reviewed.

Monitoring changes in Net Interest Margin (NIM) for both LKR and FCY on a monthly basis in Sri Lanka and Bangladesh operations remained a key focus area. Stress tests were conducted to evaluate FX position gains/losses under a 5% up/down movement in the exchange rate between USD and LKR. The Bank also assessed the impact of Mark-to-Market (MTM) gains or losses for the Fair Value Through Profit or Loss (FVTPL) portfolio of LKR Government securities and the Fair Value Through Other Comprehensive Income (FVTOCI) portfolio under interest rate changes of 1% up/down and 2% up/down.

Ongoing monitoring of opportunity losses in the amortised cost portfolio and FCY cash flow projections for the next three months was conducted to enhance risk preparedness. The Bank also maintained a summary of the FCY liquidity gap, incorporating funding liquidity against undrawn overdraft limits and anticipated loan disbursements for the following three months. Moreover, funding concentration was evaluated by tenor, value, top 20 depositors, and currency to ensure effective liquidity management.

Review of market risk

The Bank’s market risk primarily arises from interest sensitive Non-Trading Portfolio (Banking Book), which accounted for 88.02% of total assets and 88.99% of total liabilities as of December 31, 2024. The majority of the market risk exposure is attributed to Interest Rate Risk (IRR) and Foreign Exchange (FX) risk, with a minimal exposure to commodity price risk, equity price risk, and debt price risk. These latter components collectively account for less than 5% of the total risk-weighted exposure for market risk.

Further details on the Bank's market risk exposure, including an analysis of the Trading Book and Non-Trading Portfolio (Banking Book), are provided in Note 66.3.1

Market risk portfolio analysis

The gap report is prepared by categorising Rate Sensitive Assets (RSA) and Rate Sensitive Liabilities (RSL) into various time bands based on their maturity (for fixed-rate instruments) or the time remaining until their next repricing (for floating-rate instruments). The distribution of savings deposit balances is aligned with the results of a behavioural analysis conducted by the Bank and adheres to the guidelines issued by the CBSL for overdrafts and credit cards.

The Bank's exposure to interest rate volatility is represented by the gap between RSA and RSL, as illustrated in Table 55.

Interest Rate Risk (IRR)

Significant fluctuations in interest rates pose a critical risk to the Bank, as they can directly impact its Net Interest Income (NII) and the economic value of interest-earning assets, interest-bearing liabilities, and off-balance sheet items. Interest rate volatility may lead to unexpected changes in income and valuations, potentially affecting the Bank’s financial stability and profitability.

The primary types of Interest Rate Risk (IRR) the Bank is exposed to include:

- Repricing risk:Arises from differences in the timing of rate changes for assets and liabilities. This mismatch in the repricing schedules may lead to a decline in interest income or an increase in interest expense, adversely affecting NII.

- Yield curve risk:Occurs when changes in interest rates affect the slope and shape of the yield curve, which may impact the valuation of fixed-income instruments and the Bank’s balance sheet.

- Basis risk:Emerges when there are variations in the relationship between different interest rate benchmarks or indices, leading to discrepancies in the pricing of assets and liabilities.

Managing IRR is a key component of the Bank’s overall risk management framework. The Bank actively monitors interest rate movements and their potential impact, employing tools such as gap analysis, sensitivity analysis, and stress-testing to assess exposure and implement appropriate mitigation strategies. These measures enable the Bank to minimise the adverse effects of interest rate volatility while optimising its risk-adjusted returns.

Sensitivity of Net Interest Income to rate shocks Table – 54

| 2024 | 2023 | |||

| Net Interest Income (NII) | Parallel increase Rs. ’000 |

Parallel decrease Rs. ’000 |

Parallel increase Rs. ’000 |

Parallel decrease Rs. ’000 |

| As at December 31, | 805,254 | (806,045) | 100,792 | (101,013) |

| Average for the period | 830,956 | (831,385) | (18,795) | 16,928 |

| Maximum profit/(loss) for the period |

1,461,243 | (1,461,840) | 276,499 | (276,604) |

| Minimum profit/(loss) for the period |

152,547 | (152,674) | (576,068) | 557,037 |

Interest rate sensitivity gap analysis of assets and liabilities of the Banking Book Table – 55

| As at December 31, 2024 – Bank | |||||||

| Description | 0-90 days Rs. ’000 |

3 to 12 months Rs. ’000 |

1 to 3 years Rs. ’000 |

3 to 5 years Rs. ’000 |

More than 5 years Rs. ’000 |

Non-sensitive Rs. ’000 |

Total Rs. ’000 |

| Total financial assets | 692,439,066 | 470,261,258 | 531,518,432 | 438,535,282 | 322,779,332 | 158,791,765 | 2,614,325,135 |

| Total financial liabilities | 828,924,800 | 743,437,128 | 269,870,915 | 217,954,555 | 177,688,111 | 204,449,268 | 2,442,324,777 |

| Interest rate sensitivity gap | (136,485,734) | (273,175,870) | 261,647,517 | 220,580,727 | 145,091,221 | (45,657,503) | 172,000,358 |

| Cumulative gap | (136,485,734) | (409,661,604) | (148,014,087) | 72,566,640 | 217,657,861 | 172,000,358 | |

| RSA/RSL | 0.84 | 0.63 | 1.97 | 2.01 | 1.82 | 0.78 | 1.07 |

Sensitivity of projected NII

The Bank conducts regular stress-testing on Interest Rate Risk in the Banking Book (IRRBB) to evaluate its exposure to potential rate fluctuations. These tests incorporate variations in balance sheet positions, new economic variables, and a range of systemic and specific stress scenarios, ensuring that the Bank is well-prepared to manage the potential impact of adverse market movements on its profitability and financial stability.

The sensitivity of the Fixed Income Securities (FIS) portfolio, categorised under Fair Value Through Profit or Loss (FVTPL) and Fair Value Through Other Comprehensive Income (FVOCI), is assessed through stress-testing. The Bank evaluates the changes in value caused by abnormal market fluctuations using both the Economic Value of Equity (EVE) and Earnings at Risk (EAR) perspectives, generating valuable insights into how interest rate shocks affect the Bank's long-term equity value and short-term profitability.

In addition to portfolio-level analysis, the Bank continuously monitors the potential impact of interest rate shocks on Net Interest Income (NII) for both Sri Lankan Rupee (LKR) and foreign currency (FCY) exposures, helping the Bank to gauge its susceptibility to abrupt interest rate changes and the formulation of risk mitigation strategies to maintain a stable income stream.

The results of these stress tests are rigorously analysed to identify potential vulnerabilities, allowing the Bank to implement timely corrective actions and enhance its resilience to interest rate fluctuations. Detailed findings from these analyses, including projected NII sensitivities, are presented in Table 54 for further reference.

Foreign exchange risk

To mitigate potential losses stemming from fluctuations in foreign exchange (FX) rates, the Bank follows stringent risk tolerance limits for individual currency exposures and aggregate exposures. These limits are maintained within regulatory boundaries, ensuring that FX losses are minimised and remain well within the Bank’s defined risk appetite.

From December 31, 2023 to December 27, 2024, the USD/LKR exchange rate appreciated by 10.1% (Source: Central Bank of Sri Lanka,). Further details on the Bank’s exposure to currency risk in the non-trading portfolio can be found in Note 66.3.3 on page 455.

Stress-testing of the Net Open Position (NOP) is regularly performed by applying exchange rate shocks ranging from 5% to 25% to evaluate the potential impact on the Bank’s profitability and capital adequacy. As of December 31, 2024, a 5% downward movement in the exchange rate, even with the remote chance of occurrence, indicated a potential loss of Rs. 2,813 Mn. (Refer to Graph 82 on page 456 for the impact of a 5% upward change in the exchange rate). Detailed results of these stress tests are provided in Table 62.

Equity price risk

Although the Bank’s exposure to equity price risk remains minimal, daily mark-to-market calculations are performed for the Fair Value Through Profit or Loss (FVTPL) and the Fair Value Through Other Comprehensive Income (FVOCI) portfolios. Additionally, the Bank calculates the Value at Risk (VaR) for its equity portfolio to assess potential losses under adverse market conditions.

For further details, refer to Note 66.3.4 on page 456, which provides a summary of the impact of a 10% shock on equity prices on profit, other comprehensive income (OCI), and equity.

Commodity price risk

The Bank’s exposure to commodity price risk is primarily linked to fluctuations in gold prices, which impact its pawning portfolio. To mitigate this risk, the Bank has implemented a lower Loan-to-Value (LTV) ratio and conducts regular mark-to-market valuations of the portfolio to ensure effective risk management.

Liquidity risk

Liquidity risk arises from the potential inability of the Bank to meet its contractual and contingent financial obligations, on or off balance sheet, as they become due, without incurring unacceptable losses. Banks are inherently exposed to liquidity and solvency challenges resulting from mismatches in the maturities of assets and liabilities.

The primary objective of liquidity risk management is to assess and ensure the availability of adequate funds to meet these obligations promptly, under both normal operating conditions and periods of stress.

Liquid assets ratios as of December 31, 2024 are given below:

Regulatory liquidity ratios Table – 56

| As at December 31, | 2024 % |

2023 % |

| Liquidity Coverage Ratio (LCR) | ||

| Rupee | 529.20 | 491.61 |

| All currencies | 454.36 | 516.27 |

| Net Stable Funding Ratio (NSFR) | 187.29 | 193.70 |

Managing liquidity risk

The Bank adopts a comprehensive approach to managing liquidity risk, encompassing policies, procedures, measurement techniques, mitigation strategies, stress-testing methodologies, and contingency funding arrangements. Throughout most of the year, the Bank maintained excess liquidity levels. However, with credit growth gaining momentum in the latter half of the year, the Advances to Deposits & Refinance ratio improved to 66% by year-end compared to 61% at the beginning of the year. This improvement reflects the Bank’s ability to efficiently utilise its liquidity to support business growth.

The Bank continued to make substantial investments in LKR-denominated Government securities and FCY-denominated US Treasuries at optimal yields, effectively minimising potential adverse impacts on profitability. Furthermore, the negative carry experienced on specific treasury investments in prior years turned positive during the year as a result of the maturity of the underlying instruments and subsequent reinvestments at more favourable rates.

In December 2024, the Bank participated in the Ministry of Finance’s invitation to exchange its holdings of International Sovereign Bonds (ISBs). The Bank opted for the local offer, wherein 30% of the settlement was done in LKR. This move alleviated potential foreign exchange outflow pressures, positively contributing to liquidity management within the domestic financial system.

The resulting NOP created from forex sales was effectively managed within the permanent negative NOP limit prescribed by the CBSL. This proactive approach ensured that the Bank’s foreign currency exposures remained well within regulatory and internal thresholds, thereby safeguarding its liquidity position throughout the transition.

Liquidity risk review

The ALCO closely monitors the net loans-to-deposits ratio to ensure that the Bank’s asset and liability portfolios are structured to maintain a strong liquidity position. Throughout the year, the NSFR, which reflects the stability of funding sources relative to the Bank’s loans and advances, was consistently maintained well above the policy threshold of 100%. This healthy level of funding stability effectively supports the Bank’s business model and growth objectives.

The key ratios used for liquidity measurement under the stock approach are detailed below:

Key ratios used for measuring liquidity under the stock approach Table – 57

| As at December 31, | ||

| Liquidity ratios | 2024 | 2023 |

| Loans to customer deposits | 0.66 | 0.61 |

| Net loans to total assets | 0.50 | 0.46 |

| Purchased funds to total assets | 0.24 | 0.25 |

| (Large liabilities – Temporary Investments) to (Earning assets – Temporary Investments) |

0.26 | 0.27 |

| Commitment to total loans | 0.24 | 0.21 |

Maturity gap analysis

The Maturity Gap Analysis of the Bank’s assets and liabilities as of December 31, 2024, is detailed in Note 66.2.2 (a) to the Financial Statements, given on pages 446 and 447.

This analysis provides insights into the maturity structure of financial assets and liabilities, demonstrating that the Bank has sufficient funding capacity to navigate adverse scenarios in line with prescribed behavioural patterns. The assessment does not indicate any liquidity concerns, particularly considering the composition of cash outflows, which include savings deposits. These deposits are considered a quasi-stable funding source, consistent with the historical behavioural patterns of depositors, as elaborated below.

Behavioural analysis on savings accounts

In the absence of a contractual maturity agreement, savings deposits are classified as non-maturing demand deposits. These deposits lack a defined re-pricing frequency, and the Bank periodically adjusts the offered rates based on factors such as the re-pricing gap, liquidity requirements, and profitability considerations. Due to their lower sensitivity to market interest rate changes, the allocation of savings products across predefined maturity buckets in the maturity gap report is determined through simulations and behavioural studies conducted by the Bank.